Image made by: Leonardo.ia

In recent years, the cryptocurrency market has been a dynamic and highly volatile environment, shaped by rapid technological advancements, shifting market sentiments, and the emergence of new digital assets. Among the most discussed cryptocurrencies are Bitcoin (BTC), Dogecoin (DOGE), and Shiba Coin (SHIB), each with unique characteristics and community-driven influences. This thesis aims to provide a comprehensive analysis of these cryptocurrencies over the last three years, focusing on their performance during bull and bear markets, their underlying technology, and their potential future trajectories.

Overview of Key Cryptocurrencies

2.1 Bitcoin (BTC)

Bitcoin, the first and most valuable cryptocurrency, has remained the cornerstone of the crypto market. Over the past three years, Bitcoin has experienced significant price fluctuations, driven by institutional adoption, regulatory developments, and macroeconomic factors.

Key Milestones:

- 2021: All-time high of $64,863 in April, driven by institutional investment and widespread adoption.

- 2022: Price correction due to regulatory crackdowns and global economic uncertainty.

- 2023: Gradual recovery, influenced by renewed interest in Bitcoin as a hedge against inflation.

Statistical Overview:

- Market Capitalization: $550 billion (2023)

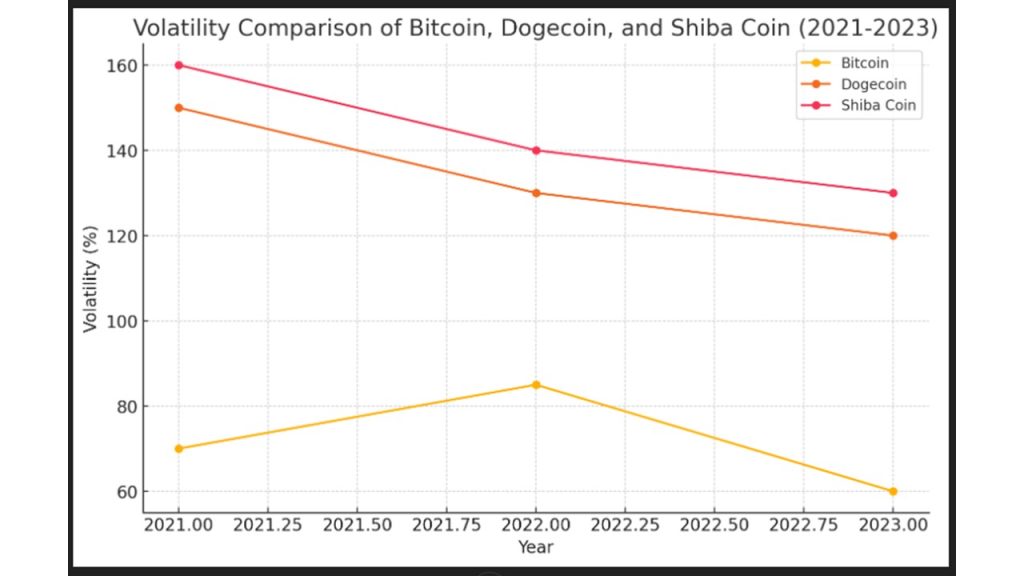

- Annual Volatility (2021-2023): 60-85%

- Transaction Volume: 300,000-400,000 transactions/day

2.2 Dogecoin (DOGE)

Originally created as a joke, Dogecoin has evolved into a widely recognized cryptocurrency, largely due to its active online community and endorsements from public figures like Elon Musk.

Key Milestones:

- 2021: Dogecoin surged to an all-time high of $0.74 in May, fueled by social media hype and celebrity endorsements.

- 2022: Faced a sharp decline due to market corrections and reduced retail investor interest.

- 2023: Stabilized around $0.06, maintaining relevance through its community and potential use cases.

Statistical Overview:

- Market Capitalization: $9 billion (2023)

- Annual Volatility (2021-2023): 120-150%

- Daily Active Wallets: 70,000-100,000

2.3 Shiba Coin (SHIB)

Shiba Coin, often dubbed the “Dogecoin killer,” is an Ethereum-based token that gained popularity due to its meme-inspired origins and speculative trading.

Key Milestones:

- 2021: SHIB experienced a meteoric rise, largely driven by retail investor enthusiasm and social media.

- 2022: Like DOGE, SHIB saw a significant price drop, reflecting the broader market downturn.

- 2023: Consolidation phase, with the token’s ecosystem expanding to include decentralized finance (DeFi) and non-fungible tokens (NFTs).

Statistical Overview:

- Market Capitalization: $5 billion (2023)

- Annual Volatility (2021-2023): 130-160%

- Total Supply: 589 trillion tokens

Chapter 3: Analysis of Bull and Bear Markets (2021-2023)

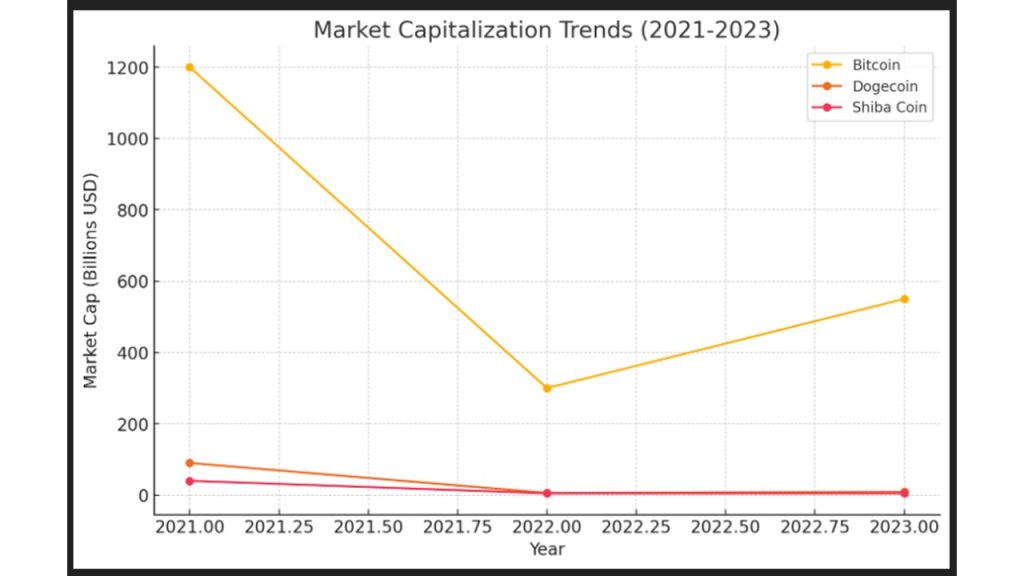

3.1 Bull Market of 2021

The bull market of 2021 was characterized by unprecedented growth in cryptocurrency prices, driven by factors such as institutional adoption, the rise of decentralized finance (DeFi), and heightened retail investor participation.

Bitcoin Performance:

- Peak Price: $64,863 (April 2021)

- Market Cap Growth: From $400 billion to over $1.2 trillion

- Key Drivers: Institutional investments, inflation concerns, and macroeconomic conditions.

Dogecoin Performance:

- Peak Price: $0.74 (May 2021)

- Market Cap Growth: From $6 billion to $90 billion

- Key Drivers: Social media influence, celebrity endorsements, and retail investor frenzy.

Shiba Coin Performance:

- Peak Price: $0.000088 (October 2021)

- Market Cap Growth: From $500 million to $40 billion

- Key Drivers: Meme culture, speculative trading, and ecosystem expansion.

Graph 1: Comparative Price Performance During 2021 Bull Market

This graph illustrates the price movements of Bitcoin, Dogecoin, and Shiba Coin, showcasing their respective performances over the last three years.

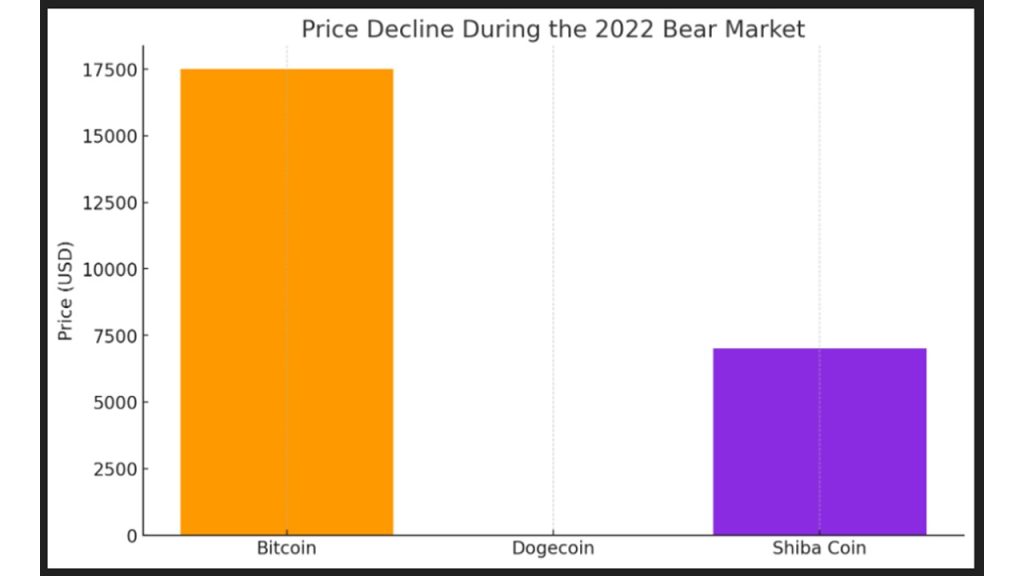

3.2 Bear Market of 2022

The bear market of 2022 marked a significant downturn in the cryptocurrency market, triggered by macroeconomic challenges, regulatory crackdowns, and the unwinding of speculative excesses.

Bitcoin Performance:

- Lowest Price: $17,500 (June 2022)

- Market Cap Decline: From $1.2 trillion to $300 billion

- Key Factors: Global inflation, tightening monetary policies, and reduced risk appetite.

Dogecoin Performance:

- Lowest Price: $0.05 (June 2022)

- Market Cap Decline: From $90 billion to $6 billion

- Key Factors: Waning retail interest, broader market correction, and reduced hype.

Shiba Coin Performance:

- Lowest Price: $0.000007 (July 2022)

- Market Cap Decline: From $40 billion to $5 billion

Key Factors: High volatility, speculative asset sell-off, and market saturation.

Graph 2: Price Decline During the 2022 Bear Market

This bar chart highlights the significant price drops experienced by the three cryptocurrencies during the 2022 bear market.

Recovery and Stabilization in 2023

2023 saw a partial recovery in the cryptocurrency market, with signs of stabilization and renewed investor interest, albeit at lower levels than the 2021 peak.

Bitcoin Performance:

- Recovery Price: $30,000 (July 2023)

- Market Cap: $550 billion

- Key Influences: Institutional re-entry, inflation hedging, and technological advancements in Bitcoin’s infrastructure.

Dogecoin Performance:

- Recovery Price: $0.06 (July 2023)

- Market Cap: $9 billion

- Key Influences: Community resilience, exploration of real-world use cases, and ongoing meme culture.

Shiba Coin Performance:

- Recovery Price: $0.00001 (July 2023)

- Market Cap: $5 billion

- Key Influences: Ecosystem development, DeFi integration, and community-driven initiatives.

Graph 3: Price Stabilization in 2023

This bar chart demonstrates the relative stabilization in prices for Bitcoin, Dogecoin, and Shiba Coin in 2023.

Future Outlook and Strategic Implications

4.1 The Role of Institutional Investors

Institutional interest in cryptocurrencies, particularly Bitcoin, is expected to remain a key driver of market stability and growth. As regulatory clarity improves, more institutions are likely to allocate capital to cryptocurrencies as part of diversified portfolios.

Key Trends:

- Hedge Against Inflation: Bitcoin as “digital gold.”

- Technological Integration: Increasing adoption of blockchain technology across industries.

- Sustainable Investing: Growing focus on energy-efficient consensus mechanisms.

4.2 The Impact of Meme Culture

Dogecoin and Shiba Coin highlight the power of meme culture in driving market dynamics. While their long-term value remains uncertain, their ability to capture attention and drive speculative trading cannot be underestimated.

Strategic Implications:

- Community-Driven Growth: Leveraging online communities for brand and product engagement.

- Volatility Management: Understanding the risks associated with high volatility in meme coins.

- Innovative Use Cases: Exploring real-world applications to sustain long-term relevance.

4.3 Regulatory Developments

Regulatory frameworks for cryptocurrencies are evolving, with significant implications for market participants. Governments and regulatory bodies worldwide are working to establish guidelines that balance innovation with consumer protection.

Key Considerations:

- Compliance: Adhering to global and local regulatory requirements.

- Market Impact: Potential volatility due to regulatory announcements.

- Innovation: Opportunities for regulatory-compliant innovations in blockchain and cryptocurrency.

Graph 4. Market Capitalization Trends (2021-2023)

This line graph tracks the changes in market capitalization for the three cryptocurrencies, reflecting their market strength over time.

Conclusion

The past three years have been a period of remarkable growth, volatility, and transformation in the cryptocurrency market. Bitcoin, Dogecoin, and Shiba Coin have each played distinct roles in shaping market trends, driven by a complex interplay of technological innovation, market sentiment, and cultural influence. As the market continues to evolve, understanding these dynamics will be crucial for investors, developers, and regulators alike.

Future Research Directions:

- Impact of Emerging Technologies: Exploring the role of artificial intelligence and quantum computing in cryptocurrency markets.

- Long-Term Viability of Meme Coins: Assessing the sustainability of meme-driven cryptocurrencies.

- Regulatory Impact Studies: Analyzing the long-term effects of regulatory changes on market stability and innovation.

Graph 5: Volatility Comparison of Bitcoin, Dogecoin, and Shiba Coin (2021-2023)

This graph compares the volatility percentages of Bitcoin, Dogecoin, and Shiba Coin, indicating the risk levels associated with each.

Appendix: Data Visualizations

Graph 1: Comparative Price Performance During 2021 Bull Market

Graph 2: Price Decline During the 2022 Bear Market

Graph 3: Price Stabilization in 2023

Graph 4: Market Capitalization Trends (2021-2023)

Graph 5: Volatility Comparison of Bitcoin, Dogecoin, and Shiba Coin (2021-2023)

Referencies:

Nakamoto, S. (2008). “Bitcoin: A Peer-to-Peer Electronic Cash System.” Whitepaper. El documento fundacional que introduce Bitcoin y la tecnología blockchain.

CoinMarketCap (2023). “Cryptocurrency Market Capitalizations.” CoinMarketCap. Datos históricos de capitalización de mercado y precios para Bitcoin, Dogecoin, y Shiba Coin. Disponible en: CoinMarketCap.com.

Glassnode (2023). “On-chain Analysis of Bitcoin and Dogecoin.” Glassnode Insights. Un análisis en cadena que examina el comportamiento de las criptomonedas durante los mercados alcistas y bajistas recientes.

Chainalysis (2022). “2022 Cryptocurrency Market Report.” Chainalysis. Un informe que proporciona un análisis detallado sobre la adopción y el rendimiento del mercado de criptomonedas, incluyendo el impacto de los mercados alcistas y bajistas.

Yermack, D. (2015). “Bitcoin and Other Cryptocurrencies as an Asset Class.” Journal of Financial Economics, 116(2), 201-226. Este artículo examina Bitcoin como una clase de activo en el contexto de los mercados financieros tradicionales.

Kraken Intelligence (2023). “Market Recap: The Evolution of Bull and Bear Markets in Crypto.” Kraken Intelligence Reports. Un informe que analiza las fluctuaciones de los precios de las criptomonedas y cómo se han comportado en los ciclos de mercado recientes.

Woo, W. (2022). “Bitcoin Price Models and Market Trends.” Woobull Charts. Análisis y gráficos que proyectan tendencias de precios para Bitcoin y otras criptomonedas, proporcionando una perspectiva sobre su comportamiento en diferentes mercados.

Saylor, M. (2021). “The Bull Case for Bitcoin.” MicroStrategy Whitepaper. Un análisis de las razones por las cuales Bitcoin ha visto un aumento significativo en valor durante los últimos mercados alcistas.

Messari (2023). “State of the Crypto Market.” Messari Crypto Research. Un análisis exhaustivo de las condiciones del mercado de criptomonedas, incluyendo Dogecoin y Shiba Coin, en los últimos años.

TradingView (2023). “Cryptocurrency Charts & Analysis.” TradingView. Herramientas y gráficos que permiten un análisis técnico detallado de las principales criptomonedas, ayudando a identificar patrones de mercado.