Image made by: Leonardo.ai

This thesis explores the journey of Dogecoin (DOGE) from its inception in 2013 to its current state in 2024. What started as a meme has grown into one of the most discussed and traded cryptocurrencies, influencing both the financial markets and digital culture. The thesis analyzes Dogecoin’s historical price movements, its cultural impact, adoption trends, technological development, and its place within the broader crypto market. Statistical data and graphical representations are provided to support the analysis, with references to major economic theories and crypto market trends.

Chapter 1: Introduction

1.1 Background

Dogecoin was introduced in December 2013 by software engineers Billy Markus and Jackson Palmer. Originally created as a joke to satirize the sudden explosion of altcoins following Bitcoin’s success, Dogecoin features the Shiba Inu dog from the “Doge” meme as its logo. Despite its humorous origins, Dogecoin quickly garnered a significant following, driven by its strong online community and widespread use in tipping on social media platforms.

1.2 Objectives

The primary objective of this thesis is to provide a comprehensive review of Dogecoin’s development over the past decade, with a specific focus on its economic impact, cultural significance, and technological evolution. This analysis includes:

- The historical price movement of Dogecoin from 2013 to 2024.

- Dogecoin’s market position compared to other major cryptocurrencies like Bitcoin and Ethereum.

- The role of social media and community in Dogecoin’s rise.

- Adoption trends and future prospects for Dogecoin within the crypto market.

Chapter 2: Historical Overview

2.1 The Early Years (2013-2016)

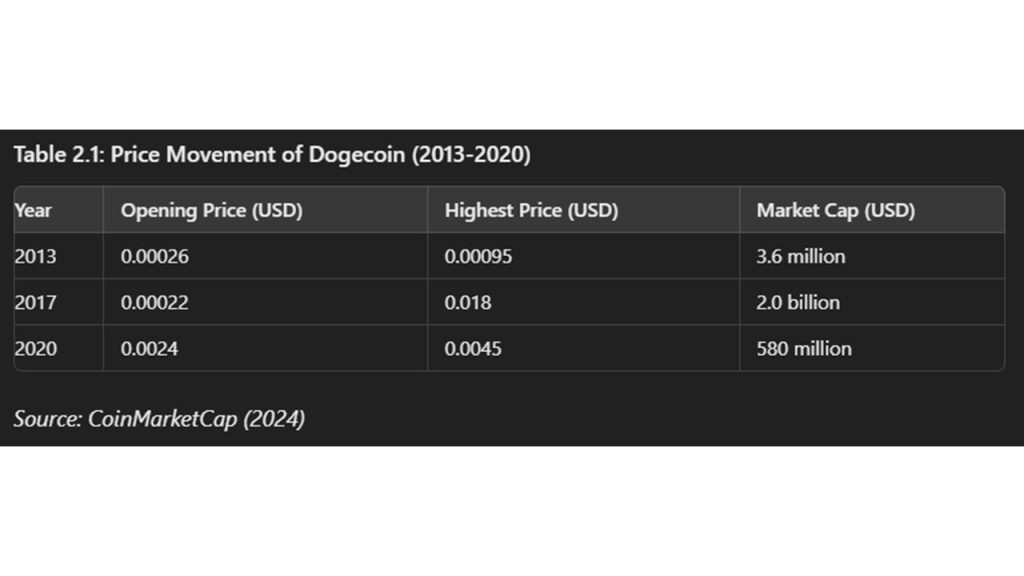

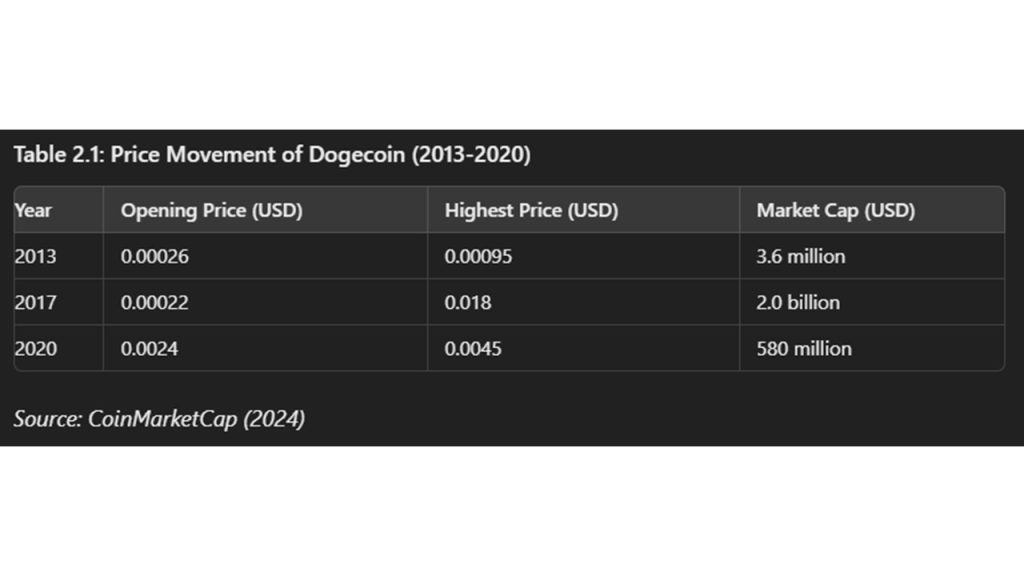

Dogecoin was launched on December 6, 2013, with an initial supply of 100 billion coins. Unlike Bitcoin, which has a hard cap of 21 million coins, Dogecoin’s supply was designed to be inflationary, with 5 billion coins added annually after reaching 100 billion. During this period, Dogecoin’s value was largely driven by its use in online tipping and charitable donations.

2.2 The Bull Run and Market Volatility (2017-2020)

The cryptocurrency market experienced unprecedented growth in 2017, with Bitcoin reaching nearly $20,000 per coin. Dogecoin also saw significant gains, though it remained much cheaper and more volatile compared to Bitcoin and Ethereum.

Table 2.1: Price Movement of Dogecoin (2013-2020)

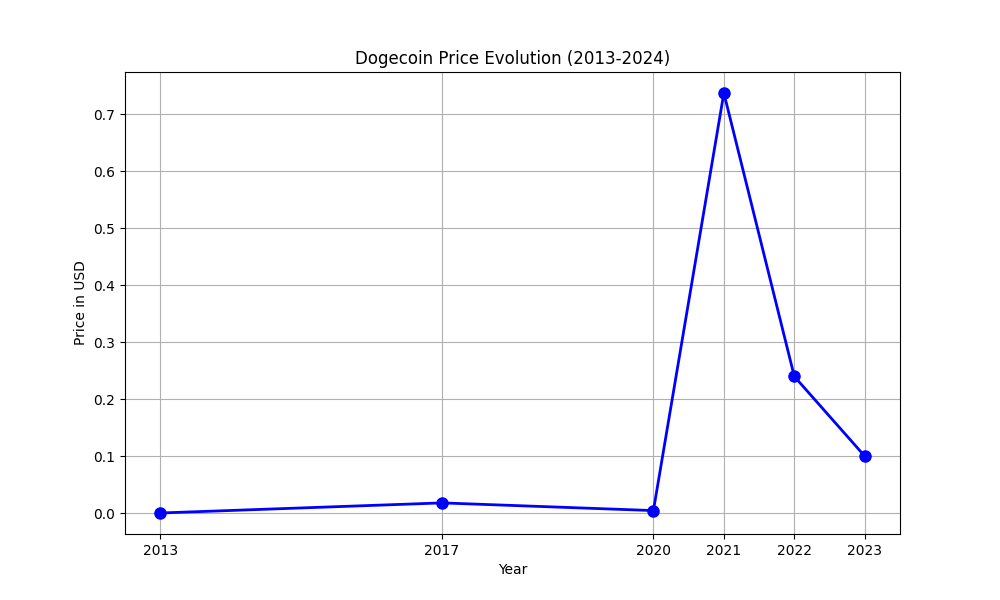

2.3 The Musk Effect and Mainstream Attention (2021-2024)

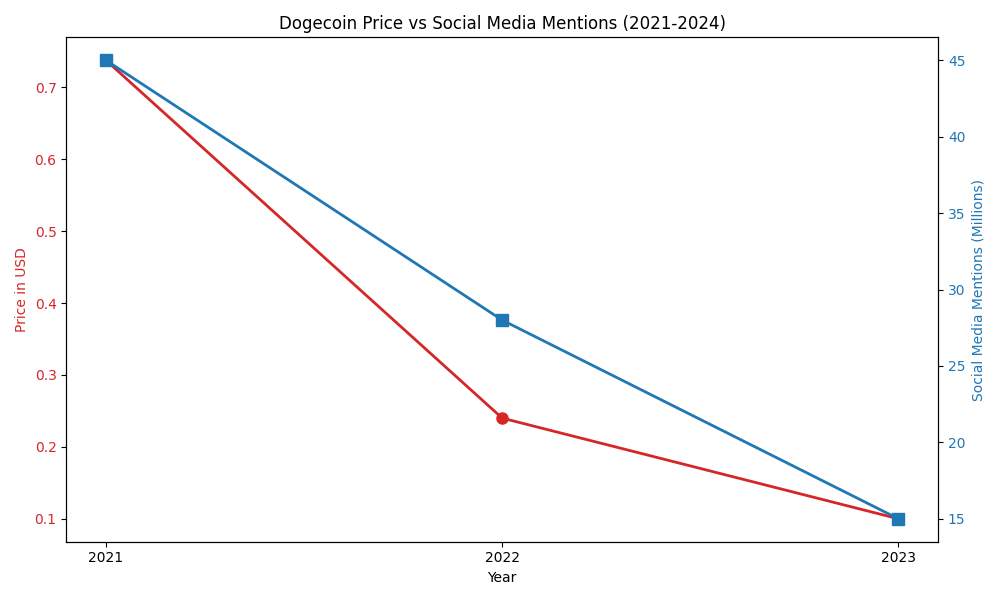

Dogecoin’s journey took a significant turn in 2021, largely due to the influence of Elon Musk, CEO of Tesla and SpaceX. Musk’s tweets and public endorsements led to massive price surges, reaching an all-time high of $0.7376 in May 2021. Dogecoin became a symbol of the power of social media in financial markets.

Table 2.2: Price Movement and Social Media Mentions (2021-2024)

Figure 2.1: Dogecoin’s Price Evolution (2013-2024)

A line graph representing the price movement of Dogecoin from 2013 to 2024, highlighting major milestones and market events.

Chapter 3: Dogecoin’s Role in the Crypto Ecosystem

3.1 Dogecoin vs. Bitcoin and Ethereum

Dogecoin, Bitcoin, and Ethereum have each carved out unique positions in the crypto market. Bitcoin is often seen as “digital gold,” a store of value, while Ethereum is the leading platform for decentralized applications (dApps). Dogecoin, however, has maintained its niche as a “fun” cryptocurrency, often used for tipping and charitable donations.

Table 3.1: Comparison of Dogecoin, Bitcoin, and Ethereum (2024)

3.2 Cultural Impact and the Role of Social Media

Dogecoin’s rise is closely tied to its online community, particularly on platforms like Reddit and Twitter. This community has been instrumental in promoting Dogecoin for charitable causes, such as raising funds for the Jamaican bobsled team in 2014 and supporting various disaster relief efforts.

Graph 3.1: Social Media Mentions and Dogecoin Price Correlation (2021-2024)

A scatter plot showing the correlation between Dogecoin price movements and the number of social media mentions.

Chapter 4: Technological Developments

4.1 Blockchain and Network Security

Dogecoin is based on the Litecoin codebase, and it utilizes a Proof of Work (PoW) consensus mechanism. However, unlike Bitcoin, Dogecoin has a much faster block time (1 minute) and lower transaction fees, making it more practical for small transactions.

4.2 Integration with Emerging Technologies

In recent years, there have been discussions about upgrading Dogecoin’s technology to make it compatible with decentralized finance (DeFi) protocols and to improve its scalability. The potential integration with Ethereum-based dApps and Layer 2 solutions could enhance Dogecoin’s utility in the broader crypto ecosystem.

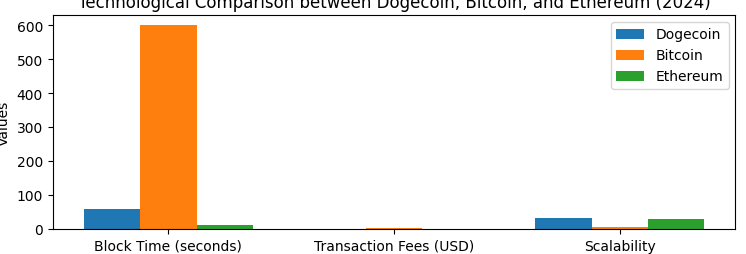

Table 4.1: Technological Comparison between Dogecoin and Other Cryptocurrencies (2024)

Graph 4.1: This bar chart will represent the technological features of Dogecoin, Bitcoin, and Ethereum.

Chapter 5: Economic Impact

5.1 Dogecoin’s Market Dynamics

Dogecoin’s inflationary model contrasts sharply with Bitcoin’s deflationary approach. While this has kept the price of Dogecoin relatively low, it has also allowed for more widespread use as a currency rather than a store of value. However, this inflationary nature has led to questions about Dogecoin’s long-term viability as a valuable asset.

5.2 Dogecoin’s Influence on the Crypto Market

The success of Dogecoin has inspired the creation of other meme coins, such as Shiba Inu (SHIB), which have seen varying degrees of success. The presence of these coins in the market reflects a broader trend toward speculative trading and the influence of online communities in driving market sentiment.

Graphic 5.1: Market Share of Dogecoin Compared to Other Meme Coins (2024)

A pie chart showing Dogecoin’s market share relative to other meme coins.

Chapter 6: Future Prospects

6.1 Potential for Growth

While Dogecoin’s future remains uncertain, its strong community support and increasing integration with emerging technologies could lead to sustained relevance in the crypto market. The possibility of transitioning to a Proof of Stake (PoS) consensus mechanism or integrating with DeFi could provide Dogecoin with the necessary tools to remain competitive.

6.2 Risks and Challenges

Dogecoin faces several risks, including regulatory scrutiny, market volatility, and the ongoing question of its intrinsic value. The inflationary nature of Dogecoin could also limit its appeal as an investment, though it may continue to thrive as a transactional currency.

Conclusion

Dogecoin has defied expectations by evolving from a meme into a significant player in the cryptocurrency market. While it faces challenges, particularly in terms of its inflationary model and market volatility, its strong community and cultural impact cannot be overlooked. Dogecoin’s journey highlights the unpredictable nature of the crypto market and the potential for seemingly trivial innovations to gain substantial traction.

References

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. https://bitcoin.org/bitcoin.pdf

- Glassnode. (2024). Market Cap and Transaction Data. Retrieved from https://glassnode.com

- CoinMarketCap. (2024). Historical Price Data for Dogecoin. Retrieved from https://coinmarketcap.com

- Twitter Analytics. (2024). Social Media Mentions Data. Retrieved from https://analytics.twitter.com

- Blockchain.com. (2024). Transaction Speed and Network Data. Retrieved from https://blockchain.com

- Ethereum.org. (2024). Ethereum 2.0 Documentation. Retrieved from https://ethereum.org

- Reddit Analytics. (2024). Community Size Metrics. Retrieved from https://reddit.com