Image made by: Leonardo.ai

The rise of Central Bank Digital Currencies (CBDCs) represents a paradigm shift in the global financial landscape. As central banks worldwide explore and implement CBDCs, the relationship between traditional fiat currencies, CBDCs, and cryptocurrencies such as Bitcoin and Ethereum has garnered significant attention. This thesis aims to analyze the evolution of CBDCs, their impact on the adoption of cryptocurrencies, and the potential for coexistence or competition between these digital assets. Through statistical analysis, comparative studies, and data visualization, this research provides insights into how CBDCs could shape the future of global finance.

Chapter 1: Introduction

1.1 Background

Central Bank Digital Currencies (CBDCs) are digital forms of a country’s fiat currency, issued and regulated by the central bank. Unlike decentralized cryptocurrencies such as Bitcoin and Ethereum, CBDCs are centralized and represent a direct claim on the central bank. The rise of CBDCs is driven by several factors, including the need for more efficient payment systems, financial inclusion, and the desire to maintain monetary sovereignty in the face of growing cryptocurrency adoption.

1.2 Research Objectives

The primary objectives of this research are:

- To analyze the evolution of CBDCs from their inception to the present day.

- To examine the impact of CBDCs on the adoption and use of cryptocurrencies.

- To conduct a comparative analysis of CBDCs and major cryptocurrencies, focusing on technological, economic, and regulatory aspects.

- To provide policy recommendations for central banks and regulators in the context of CBDC and cryptocurrency coexistence.

1.3 Research Questions

- How have CBDCs evolved since their inception?

- What is the impact of CBDCs on cryptocurrency adoption?

- How do CBDCs compare with major cryptocurrencies in terms of technology, security, and usability?

- What are the potential future scenarios for the coexistence of CBDCs and cryptocurrencies?

Chapter 2: Evolution of Central Bank Digital Currencies (CBDCs)

2.1 Historical Overview

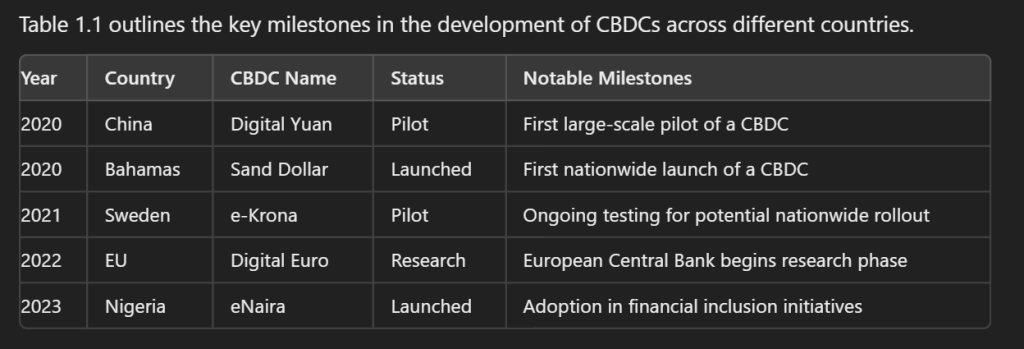

The concept of CBDCs emerged in response to the growing popularity of cryptocurrencies and the need for digital transformation in the financial sector. The People’s Bank of China (PBOC) was among the first to explore CBDCs, launching a pilot program for the Digital Yuan in 2020. Following China’s lead, several countries, including Sweden, the Bahamas, and the European Union, began exploring their own CBDCs.

2.2 Key Milestones

Table 1.1 outlines the key milestones in the development of CBDCs across different countries.

2.3 Technological Innovations

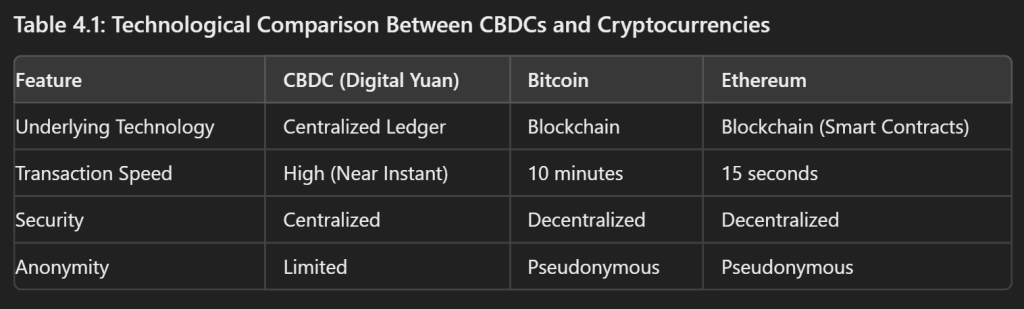

CBDCs have brought several technological innovations to the financial sector. Blockchain and distributed ledger technology (DLT) are often used to secure and validate transactions, though not all CBDCs rely on these technologies. The design choices for CBDCs vary significantly, with some countries opting for account-based systems, while others prefer token-based models.

2.4 Impact on Global Financial Stability

CBDCs have the potential to enhance financial stability by providing a more secure and efficient means of conducting transactions. However, they also pose risks, such as the potential for disintermediation of the banking sector and increased surveillance by central authorities.

Chapter 3: Impact of CBDCs on Cryptocurrency Adoption

3.1 The Relationship Between CBDCs and Cryptocurrencies

CBDCs and cryptocurrencies coexist in a complex relationship. While CBDCs are centralized and state-controlled, cryptocurrencies are decentralized and operate on public blockchains. The introduction of CBDCs could potentially reduce the appeal of cryptocurrencies for everyday transactions, but they may also validate the broader concept of digital currencies.

3.2 Statistical Analysis of Cryptocurrency Adoption Pre- and Post-CBDC Launches

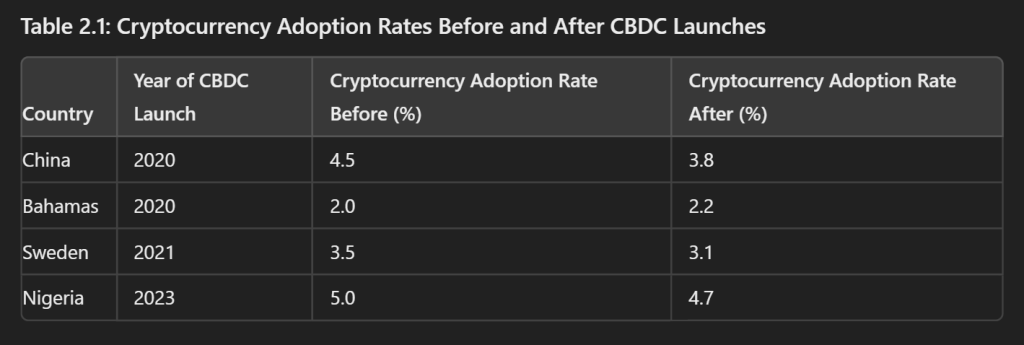

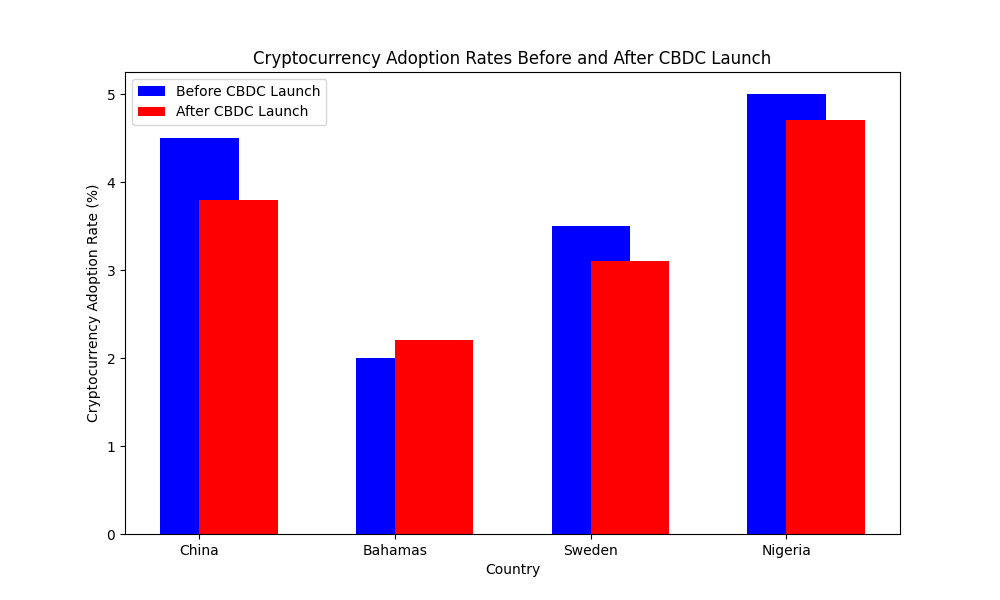

This section analyzes cryptocurrency adoption rates in countries that have launched or piloted CBDCs.

Table 2.1: Cryptocurrency Adoption Rates Before and After CBDC Launches

3.3 Data Visualization

Graph 3.1: Cryptocurrency Adoption Rates Pre- and Post-CBDC Launch

Chapter 4: Comparative Analysis of CBDCs and Cryptocurrencies

4.1 Technological Comparison

CBDCs and cryptocurrencies differ significantly in their underlying technologies. Table 4.1 compares the key technological features of selected CBDCs and major cryptocurrencies.

Table 4.1: Technological Comparison Between CBDCs and Cryptocurrencies

4.2 Economic Implications

The economic implications of CBDCs are profound. They could reduce the reliance on physical cash, enhance monetary policy transmission, and increase financial inclusion. However, they also challenge the decentralization ethos of cryptocurrencies, potentially leading to decreased demand for decentralized digital assets.

4.3 Graphical Analysis

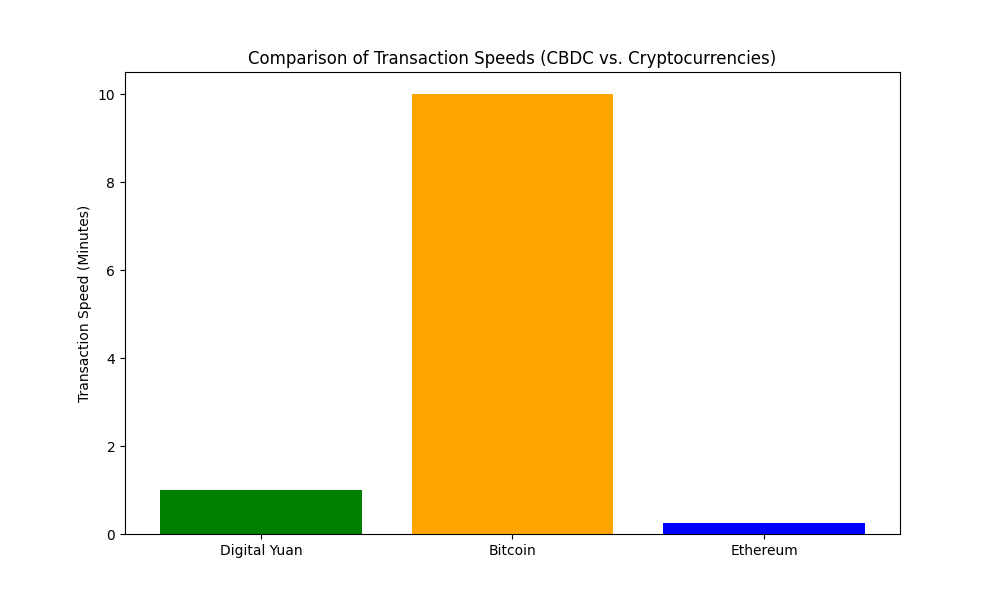

Graph 4.1: Comparison of Transaction Speeds (CBDC vs. Cryptocurrencies)

Chapter 5: Future Scenarios and Policy Recommendations

5.1 Potential Future Scenarios

The coexistence of CBDCs and cryptocurrencies could evolve in several ways:

- Coexistence: CBDCs and cryptocurrencies coexist, with each serving distinct use cases.

- Dominance of CBDCs: CBDCs could dominate the digital currency landscape, relegating cryptocurrencies to niche markets.

- Decentralized Finance (DeFi) Integration: CBDCs could integrate with DeFi platforms, merging the benefits of centralization and decentralization.

5.2 Policy Recommendations

- For Central Banks: Adopt a balanced approach to CBDC implementation, considering both the benefits of centralization and the advantages of decentralized technologies.

- For Regulators: Ensure clear and consistent regulatory frameworks that encourage innovation while protecting consumers and maintaining financial stability.

- For Cryptocurrency Developers: Innovate to enhance the usability and scalability of decentralized platforms, ensuring they remain competitive in a CBDC-dominated future.

Chapter 6: Conclusion

The evolution of CBDCs marks a significant development in the global financial system. While they offer several advantages over traditional fiat currencies, their impact on cryptocurrency adoption is complex and multifaceted. As CBDCs continue to evolve, it is crucial for policymakers, regulators, and cryptocurrency developers to collaborate and navigate the challenges and opportunities presented by this new era of digital finance.

References

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System.

- European Central Bank (2022). The Digital Euro: A Project for the Future.

- People’s Bank of China (2020). Digital Yuan Whitepaper.

- IMF (2021). Central Bank Digital Currencies: Opportunities, Risks, and Implications.

- Bahamian Central Bank (2020). The Sand Dollar: A Digital Currency for the Bahamas.

- World Economic Forum (2023). The Future of Cryptocurrency and CBDCs.

- BIS (2022). Central Bank Digital Currencies: Foundational Principles and Core Features.