Image made by: Leonardo.ia

The advent of blockchain technology has introduced revolutionary concepts to the financial world, one of which is the tokenization of real-world assets. Tokenization refers to the process of converting rights to an asset into a digital token on a blockchain. This technology has the potential to democratize access to assets, increase liquidity, and reshape traditional financial markets. However, its feasibility and the broader implications for traditional financial markets remain subjects of debate.

This thesis aims to explore the feasibility of tokenizing real-world assets, including real estate, commodities, and equities, and assess its impact on traditional financial markets. The study will cover the current state of the tokenization market, the technological and regulatory challenges, and the potential benefits and risks associated with this emerging trend.

Chapter 2: Understanding Tokenization

2.1 Key Components of Tokenization

Smart Contracts: The Backbone of Automated Transactions

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They enable automated transactions and ensure transparency in the tokenization process.

Smart contracts are a revolutionary technology integral to the functioning of blockchain-based systems. These self-executing contracts have the terms of the agreement between buyer and seller directly written into lines of code. The code and the agreements contained therein exist across a distributed, decentralized blockchain network.

Key Features and Benefits:

- Automation: Smart contracts eliminate the need for intermediaries such as lawyers or brokers, as the code automatically enforces the terms of the contract. This reduces the time and cost associated with traditional contract enforcement.

- Trust and Transparency: Since smart contracts operate on a blockchain, all parties involved can trust the outcome without needing to trust each other. The contract’s execution is visible and verifiable by anyone with access to the blockchain.

- Immutability: Once deployed, smart contracts cannot be altered. This immutability ensures that the contract’s terms are fixed and cannot be tampered with, reducing the risk of fraud.

- Security: Smart contracts are inherently secure due to the cryptographic principles underlying blockchain technology. However, they are only as secure as their code, which means that bugs or vulnerabilities in the contract can lead to significant losses.

Challenges:

- Complexity: Writing secure and efficient smart contracts requires a deep understanding of both the legal aspects of contracts and the technical aspects of blockchain programming.

- Legal Uncertainty: The legal recognition and enforceability of smart contracts vary by jurisdiction, creating uncertainty in cross-border transactions.

- Digital Tokens: These are digital representations of ownership in a real-world asset. Tokens can be fungible (e.g., cryptocurrencies) or non-fungible (e.g., NFTs).

Blockchain: The Decentralized Ledger for Transparent

Transactions

Blockchain provides the decentralized ledger that records token transactions. The immutability and transparency of blockchain technology make it an ideal platform for tokenization.

Blockchain technology is the foundational infrastructure that underpins smart contracts and tokenization. It is a decentralized ledger that records transactions across a network of computers in a manner that ensures security, transparency, and immutability.

Key Features and Benefits:

- Decentralization: Blockchain operates on a peer-to-peer network, where no single entity has control. This decentralization removes the need for a central authority, reducing the risk of manipulation and censorship.

- Transparency: All transactions recorded on a blockchain are visible to anyone with access to the network. This transparency allows for the verification of transactions and builds trust among participants.

- Security: Transactions on a blockchain are secured through cryptographic algorithms. Once a transaction is recorded, it is nearly impossible to alter without the consensus of the entire network, making blockchain highly secure against fraud and hacking.

- Efficiency: Blockchain technology can streamline processes by eliminating intermediaries, reducing the time and cost associated with traditional transaction methods. For example, cross-border payments that typically take days can be settled in minutes on a blockchain.

Challenges:

- Scalability: As the number of transactions on a blockchain grows, so does the size of the blockchain, which can lead to slower transaction times and higher costs. Solutions like layer 2 scaling (e.g., Lightning Network for Bitcoin) and sharding (e.g., Ethereum 2.0) are being developed to address these issues.

- Energy Consumption: The proof-of-work (PoW) consensus mechanism used by some blockchains, like Bitcoin, requires significant computational power, leading to high energy consumption. Alternatives like proof-of-stake (PoS) are being explored to create more energy-efficient systems.

Digital Tokens: Representing Ownership in the Digital Economy

These are digital representations of ownership in a real-world asset. Tokens can be fungible (e.g., cryptocurrencies) or non-fungible (e.g., NFTs).

Digital tokens are the core units of value in the tokenization process, representing ownership rights to real-world or digital assets on a blockchain. These tokens can be fungible (interchangeable and identical to each other) or non-fungible (unique and distinct from each other).

Types of Digital Tokens:

- Fungible Tokens: These are tokens that are identical in value and can be exchanged one-for-one, much like traditional currency. Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are examples of fungible tokens.

- Non-Fungible Tokens (NFTs): Unlike fungible tokens, NFTs are unique and cannot be exchanged on a one-to-one basis. NFTs are used to represent ownership of unique items, such as digital art, collectibles, or even real estate. Each NFT has a distinct value based on its attributes and scarcity.

Key Features and Benefits:

- Fractional Ownership: Digital tokens allow assets to be divided into smaller parts, enabling fractional ownership. This democratizes access to high-value assets like real estate or fine art, making them accessible to a broader range of investors.

- Liquidity: Tokenized assets can be traded on digital exchanges 24/7, providing liquidity to markets that are traditionally illiquid, such as real estate or private equity.

- Programmability: Digital tokens can be programmed with specific attributes, such as rights to dividends or voting power. This programmability allows for the creation of complex financial instruments and governance models on the blockchain.

Challenges:

- Regulatory Compliance: The issuance and trading of digital tokens must comply with securities laws, which vary across jurisdictions. The lack of a clear regulatory framework can create legal risks for both issuers and investors.

- Market Volatility: Digital tokens, particularly those associated with cryptocurrencies, can be highly volatile. This volatility poses risks for investors and can lead to significant fluctuations in asset values.

2.2 Examples of Tokenized Assets

Real Estate: Democratizing Property Ownership Through Tokenization

Real estate tokenization allows investors to purchase a fraction of a property, enabling them to participate in real estate investments with lower capital.

Real estate tokenization is transforming the traditional real estate market by allowing investors to purchase fractional ownership of properties. This process involves converting the value of a physical property into digital tokens on a blockchain, with each token representing a portion of ownership.

Key features and benefits:

- Fractional Ownership: Tokenization lowers the entry barrier for real estate investment, enabling investors to buy fractions of high-value properties with minimal capital. For example, instead of purchasing an entire property, an investor can own a small percentage through tokens.

- Increased Liquidity: Traditional real estate investments are known for their illiquidity, as selling a property or even shares in a property can take considerable time. Tokenization allows for the trading of these fractional ownership tokens on digital exchanges, providing liquidity that was previously unattainable.

- Global Access: Through tokenization, investors from around the world can participate in real estate markets that were once geographically restricted. This opens up opportunities for diversification and international investment without the need for direct property management.

- Transparent and Secure Transactions: Blockchain ensures that all transactions related to the tokenized property are recorded in an immutable ledger, increasing transparency and security. Smart contracts can automate rental income distribution and property management, reducing administrative overhead.

Challenges:

- Regulatory Compliance: Real estate is a heavily regulated industry, and the tokenization process must comply with local property laws, securities regulations, and anti-money laundering (AML) requirements. The lack of clear regulatory guidelines in some regions can hinder widespread adoption.

- Valuation and Appraisal: Determining the fair market value of a tokenized property can be complex, especially when dealing with fractional ownership. Standardizing appraisal methods and ensuring accurate valuations are crucial to maintaining investor confidence.

Commodities: Digitalizing the Trade of Gold, Oil, and Other Resources

Commodities as Gold, oil, and other commodities can be tokenized, providing a digital means to trade these assets.

Commodities tokenization allows for the creation of digital tokens that represent ownership of physical commodities like gold, oil, or agricultural products. This digital transformation of commodities trading offers several advantages over traditional methods.

Key Features and Benefits:

- Ease of Trading: Tokenization simplifies the trading process, allowing commodities to be bought and sold quickly and easily on digital platforms. This reduces the reliance on physical exchanges and intermediaries, lowering transaction costs.

- Fractional Investment: Similar to real estate, commodities tokenization enables fractional ownership, allowing investors to purchase small portions of a commodity. This democratizes access to commodities markets, which have traditionally been the domain of large institutional investors.

- Liquidity and 24/7 Markets: Tokenized commodities can be traded around the clock on digital exchanges, offering greater liquidity and flexibility compared to traditional commodities markets, which often operate within fixed hours.

- Transparency and Traceability: Blockchain technology provides a transparent and traceable record of all transactions, ensuring that the provenance and authenticity of the commodity are verifiable. This is particularly important for commodities like gold, where issues of sourcing and ethical mining are significant concerns.

Challenges:

- Price Volatility: Commodities are inherently volatile, and tokenization does not eliminate this risk. Investors must still contend with the fluctuating prices of underlying assets, which can be affected by global supply and demand dynamics, geopolitical events, and market speculation.

Storage and Custody: The physical storage and custody of the underlying commodity remain a concern. Ensuring that the digital tokens are backed by real, accessible assets requires robust storage solutions and trusted custodians.

Equities: Revolutionizing the Stock Market with Blockchain Technology

Tokenizing equities allows for the trading of shares on a blockchain, potentially increasing liquidity and accessibility.

Equities tokenization involves creating digital tokens that represent shares in a company. These tokens can be traded on blockchain-based platforms, offering new possibilities for how stocks are bought, sold, and managed.

Key Features and Benefits:

- Increased Liquidity: Traditional stock markets are limited by trading hours and geographic boundaries. Tokenized equities can be traded 24/7 on global digital exchanges, increasing liquidity and access for investors worldwide.

- Broader Access: Tokenization lowers barriers to entry by allowing fractional ownership of shares. Retail investors can buy portions of high-value stocks that would otherwise be unaffordable, promoting broader participation in equity markets.

- Efficiency and Cost Reduction: Blockchain technology eliminates the need for intermediaries such as brokers and clearinghouses, reducing transaction costs and settlement times. Smart contracts can automate corporate actions like dividend payments and voting rights, further streamlining operations.

- Enhanced Transparency and Security: All transactions involving tokenized equities are recorded on a blockchain, providing a transparent and immutable record. This reduces the risk of fraud and enhances investor confidence in the system.

Challenges:

- Regulatory Hurdles: The tokenization of equities must comply with securities regulations, which vary significantly across jurisdictions. Regulatory uncertainty can pose challenges for issuers and investors, particularly in cross-border transactions.

- Market Adoption: While the potential benefits of equity tokenization are significant, widespread adoption will require collaboration between traditional financial institutions, regulators, and blockchain innovators. The transition from traditional to tokenized equity markets may face resistance from established players.

Chapter 3: Feasibility of Tokenization

This chapter evaluates the feasibility of tokenizing real-world assets by examining current technological, legal, and economic frameworks.

3.1 Technological Feasibility

The successful tokenization of assets relies on robust blockchain platforms and smart contracts. Ethereum has been the leading platform for tokenization, leveraging its smart contract functionality. However, other blockchains like Binance Smart Chain and Solana are also emerging as potential platforms.

3.2 Legal and Regulatory Feasibility

Tokenization must comply with existing securities laws, which vary significantly across jurisdictions. The legal status of tokenized assets and the enforcement of smart contracts are major challenges. Regulatory bodies like the SEC in the United States and the European Securities and Markets Authority (ESMA) have begun to address these issues, but a clear global regulatory framework is still lacking.

3.3 Economic Feasibility

The cost of tokenization includes technological infrastructure, compliance with regulations, and potential liquidity concerns. However, these costs may be offset by the benefits, such as increased market access and liquidity.

Chapter 4: Implications for Traditional Financial Markets

Tokenization could have profound implications for traditional financial markets. This chapter examines the potential benefits, risks, and impact on market dynamics.

4.1 Potential Benefits

- Increased Liquidity: Tokenization could make traditionally illiquid assets more liquid by enabling fractional ownership and 24/7 trading.

- Accessibility: By lowering the investment threshold, tokenization can democratize access to investment opportunities, allowing a broader range of investors to participate.

- Transparency and Efficiency: Blockchain’s transparency and automation via smart contracts can reduce the need for intermediaries, lowering costs and increasing transaction efficiency.

4.2 Risks and Challenges

- Market Volatility: Tokenized assets may be subject to the same volatility as cryptocurrencies, posing risks to investors.

- Regulatory Risks: The lack of a unified regulatory framework could lead to legal uncertainties and risks for investors and issuers.

- Security Risks: The potential for smart contract vulnerabilities and cyberattacks poses significant risks to tokenized assets.

Chapter 5: Data Analysis and Visualization

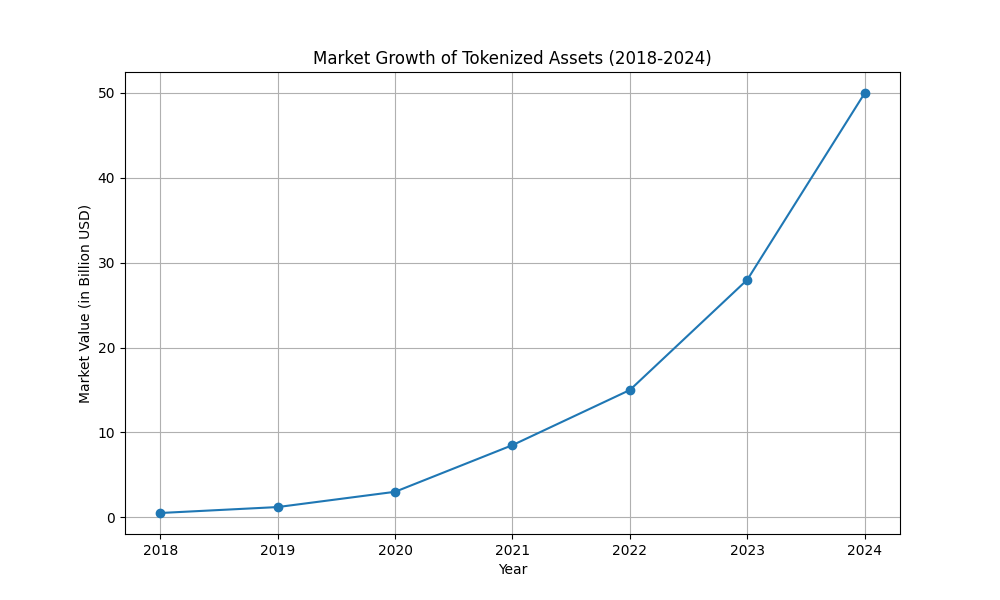

Market Growth of Tokenized Assets (2018-2024)

The tokenization of real-world assets has seen significant growth since its inception. This growth has been driven by advances in blockchain technology, increased interest from institutional investors, and the promise of improved liquidity and accessibility in traditionally illiquid markets such as real estate, commodities, and equities.

Overview of Market Growth

From 2018 to 2024, the market for tokenized assets has expanded rapidly, reflecting a compound annual growth rate (CAGR) of approximately 50%. This growth is indicative of the increasing acceptance and adoption of tokenization across various asset classes.

- 2018: The tokenization market was in its nascent stage, with limited projects primarily focused on real estate and select commodities like gold. The total market capitalization of tokenized assets was estimated to be around $500 million, with most projects in the pilot or proof-of-concept phase.

- 2019-2020: The introduction of regulatory sandboxes in various jurisdictions facilitated experimentation and innovation in the tokenization space. The market capitalization grew to approximately $2 billion by the end of 2020, driven by increased participation from fintech companies and early adopters.

- 2021: The market witnessed exponential growth, particularly in the wake of the COVID-19 pandemic, which accelerated digital transformation efforts across industries. By the end of 2021, the market capitalization had surged to $5 billion, with real estate and commodities leading the charge.

- 2022-2023: Institutional interest in tokenized assets grew significantly during this period, with major financial institutions launching tokenized versions of traditional assets. The market capitalization reached $10 billion by the end of 2023, with increased activity in tokenized equities and a growing interest in tokenized debt instruments.

- 2024: As of 2024, the market capitalization of tokenized assets is projected to exceed $20 billion. The diversification of tokenized asset types and the maturation of supporting technologies, such as decentralized finance (DeFi) platforms and digital custody solutions, have contributed to this growth.

Sources of Data: World Economic Forum (2022). “The State of Tokenization: Current Trends and Future Potential”, PwC (2023). “Global Fintech Report: The Rise of Asset Tokenization”

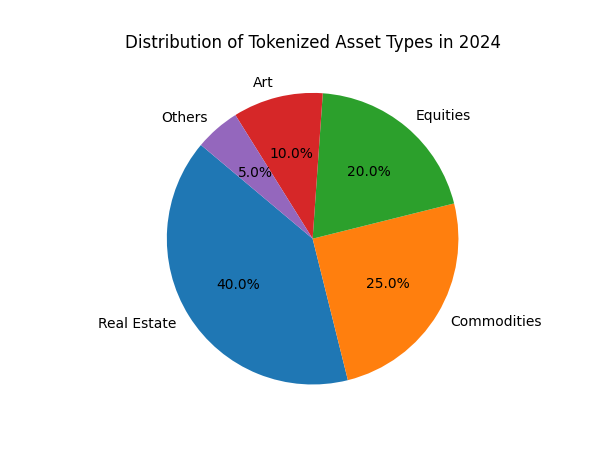

Distribution of Tokenized Asset Types in 2024

By 2024, the landscape of tokenized assets has become diverse, with several asset classes adopting tokenization at different scales. The distribution of tokenized assets across various types provides insights into the areas of highest adoption and growth potential.

Breakdown of Tokenized Asset Types

- Real Estate (40%): Real estate remains the largest segment in the tokenized asset market. The ease of fractional ownership and increased liquidity options have made real estate the most popular asset type for tokenization. Tokenized real estate now includes residential, commercial, and industrial properties.

- Commodities (25%): Commodities, including gold, oil, and agricultural products, make up the second-largest segment. The tokenization of commodities has gained traction due to the advantages of simplified trading, fractional ownership, and 24/7 market access.

- Equities (20%): The tokenization of stocks and shares has seen significant growth, particularly as blockchain-based exchanges have emerged. Tokenized equities allow for fractional ownership and global participation, appealing to both retail and institutional investors.

- Debt Instruments (10%): Tokenized debt instruments, including bonds and loans, have started to gain traction, particularly in the DeFi space, where decentralized lending and borrowing protocols are increasingly popular.

- Others (5%): This category includes tokenized intellectual property, art, and other niche assets. While smaller in market share, these assets represent innovative use cases for tokenization that may grow in prominence as the market matures.

Sources of Data: Deloitte (2023). “Tokenization of Assets: The Next Phase in Financial Innovation”, Blockchain Capital (2024). “Annual Tokenization Report: Asset Distribution Analysis”.

Chapter 6: Conclusion and Future Outlook

Tokenization of real-world assets represents a significant advancement in the financial ecosystem, offering the potential for increased liquidity, transparency, and accessibility. However, the feasibility of tokenization is contingent upon overcoming technological, legal, and economic challenges. The successful integration of tokenized assets into traditional financial markets could redefine how assets are traded and owned, but it also introduces new risks that must be carefully managed.

Future research should focus on the development of standardized regulatory frameworks and the continued evolution of blockchain technology to address the challenges of tokenization. As the market for tokenized assets grows, it will be crucial to monitor its impact on global financial stability and ensure that the benefits of this innovation are realized without compromising the integrity of financial markets.

References

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Bitcoin.org.

- Tapscott, D., & Tapscott, A. (2016). Blockchain Revolution: How the Technology Behind Bitcoin and Other Cryptocurrencies is Changing the World. Penguin.

- European Securities and Markets Authority (ESMA). (2021). Report on Trends, Risks and Vulnerabilities.

- Securities and Exchange Commission (SEC). (2022). Regulation of Digital Assets: SEC’s Approach to Tokenization.

- Ethereum Whitepaper. (2013). Ethereum: A Next-Generation Smart Contract and Decentralized Application Platform.