Image made by: Leonardo.ia

The global financial landscape has undergone seismic shifts over the past decade, driven by the rapid advancement of blockchain technology, the proliferation of cryptocurrencies, and the conceptual evolution of the internet through Web 3.0 and Web 4.0. This thesis explores the intricate and evolving relationship between cryptomarkets, blockchain, and their impact on traditional financial assets such as fiat currency and gold. The analysis will delve into underexplored aspects of these dynamics, particularly focusing on the redistribution of global economic power and the erosion of central banking authority.

The Evolution of Cryptomarkets and Blockchain Technology

Cryptomarkets have grown exponentially since the inception of Bitcoin in 2009. What began as an experiment in decentralized finance has transformed into a multi-trillion-dollar market, challenging the supremacy of traditional financial systems.

Table 2.1: Growth of Cryptomarkets (2013-2023)

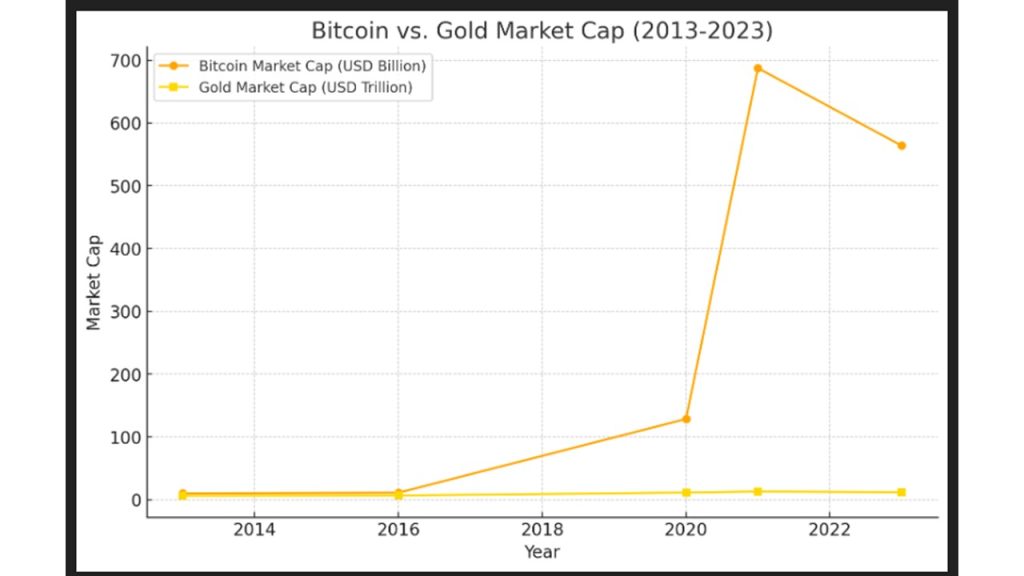

Graph 4.1: Bitcoin vs. Gold Market Cap (2013-2023). This graph shows the relative growth of Bitcoin’s market cap compared to gold, highlighting the growing perception of Bitcoin as a digital store of value.

Web 3.0, Web 4.0, and the Decentralization of Power

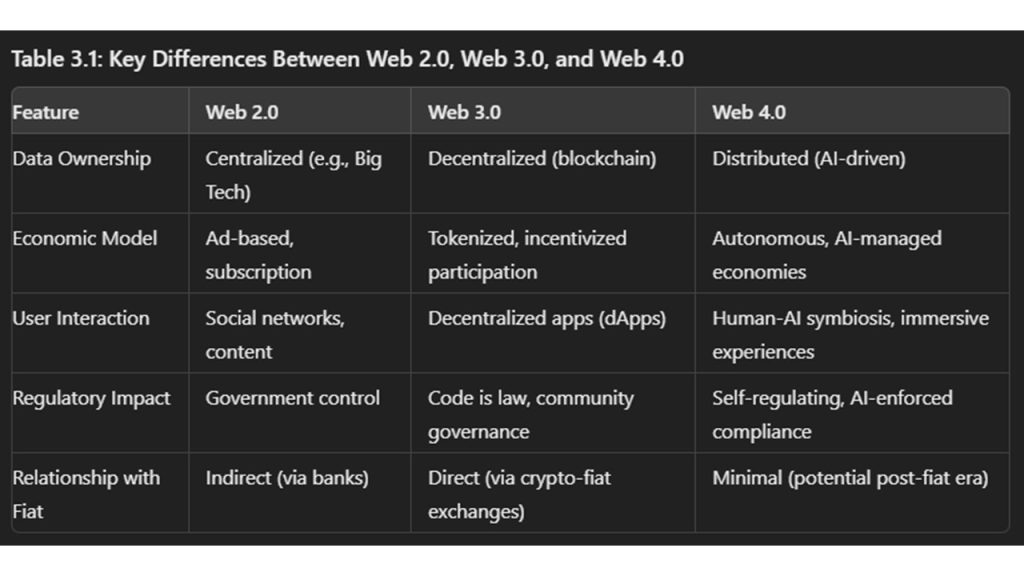

Web 3.0 introduces a paradigm shift towards decentralization, enabling peer-to-peer interactions, tokenized ecosystems, and self-sovereign identities. Web 4.0, although nascent, hints at a future where AI-driven automation and ubiquitous connectivity redefine economic structures.

Table 3.1: Key Differences Between Web 2.0, Web 3.0, and Web 4.0

Impact of Cryptocurrencies on Fiat Currency and Gold

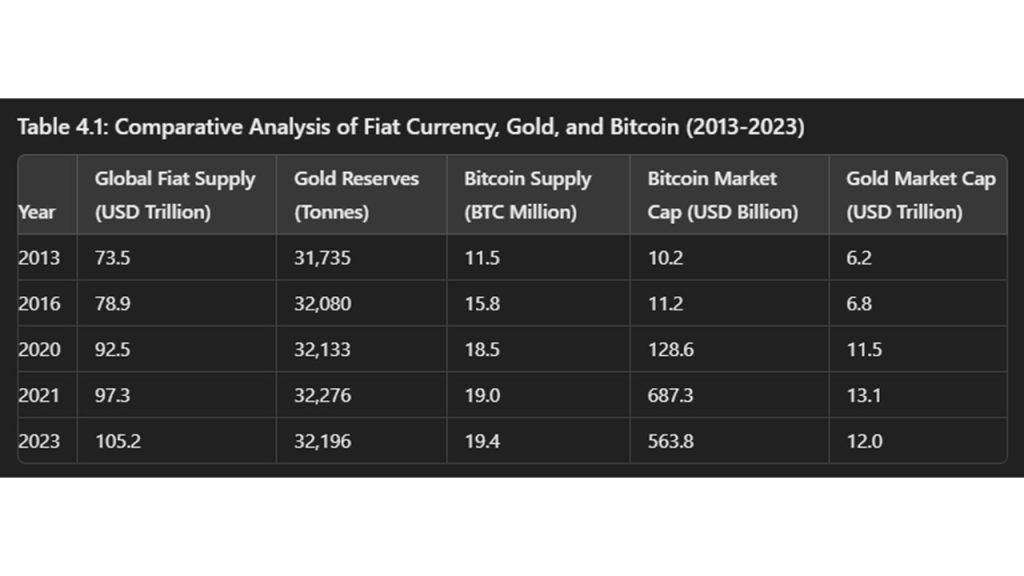

The emergence of cryptocurrencies presents an existential challenge to fiat currency, traditionally underpinned by state authority. Gold, as a historical store of value, faces competition from Bitcoin, which is increasingly viewed as “digital gold.”

Table 4.1: Comparative Analysis of Fiat Currency, Gold, and Bitcoin (2013-2023)

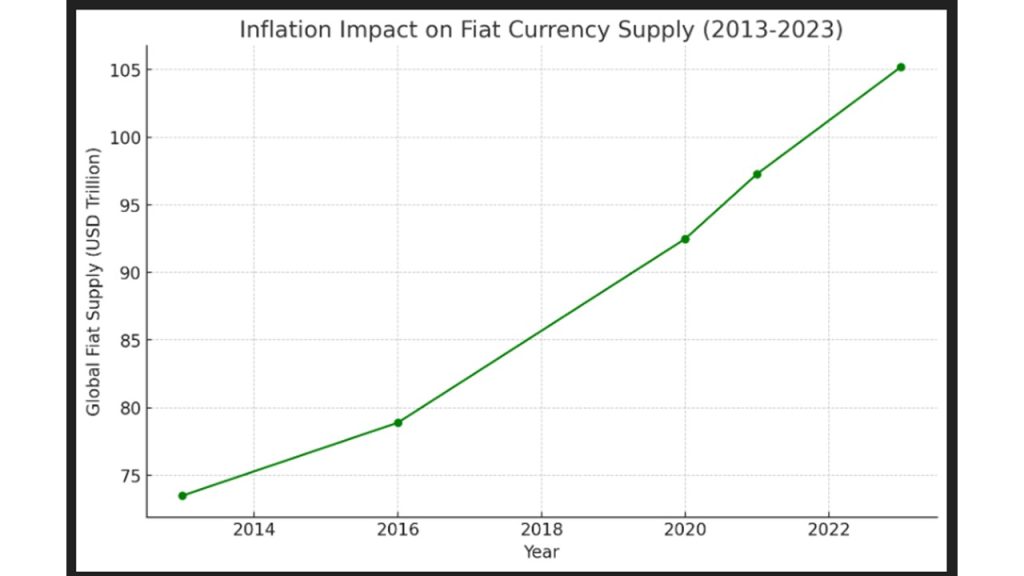

Graph 4.2: Inflation Impact on Fiat Currency Supply (2013-2023)

The Bull and Bear Cycles in Cryptomarkets (2020-2023)

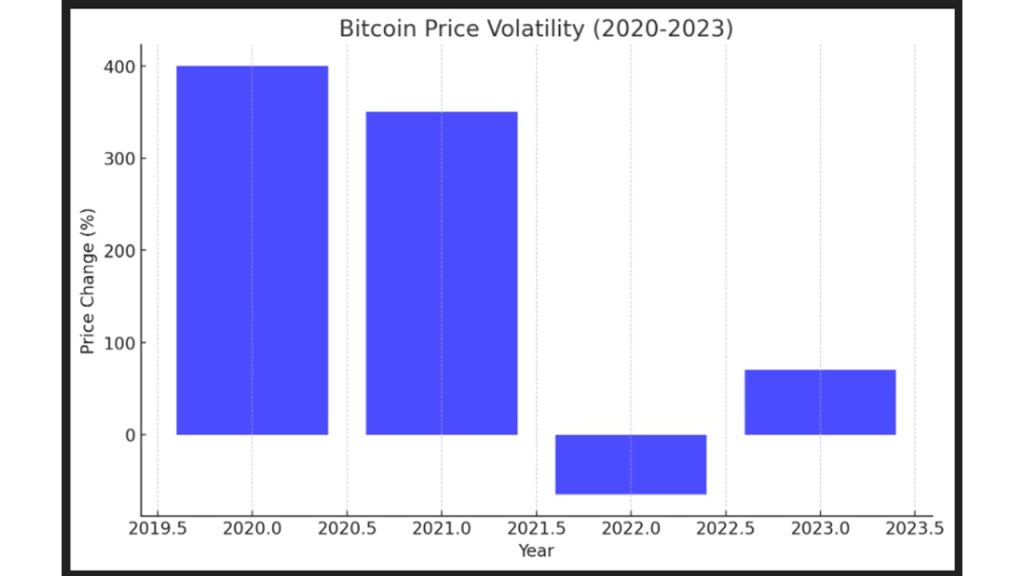

The past three years have been marked by intense volatility, with cryptomarkets experiencing both euphoric bull markets and devastating bear markets.

Table 5.1: Major Bull and Bear Market Phases (2020-2023)

Graph 5.1: Bitcoin Price Volatility (2020-2023). This graph depicts the extreme price fluctuations of Bitcoin, reflecting the market’s sensitivity to both internal developments and external economic factors.

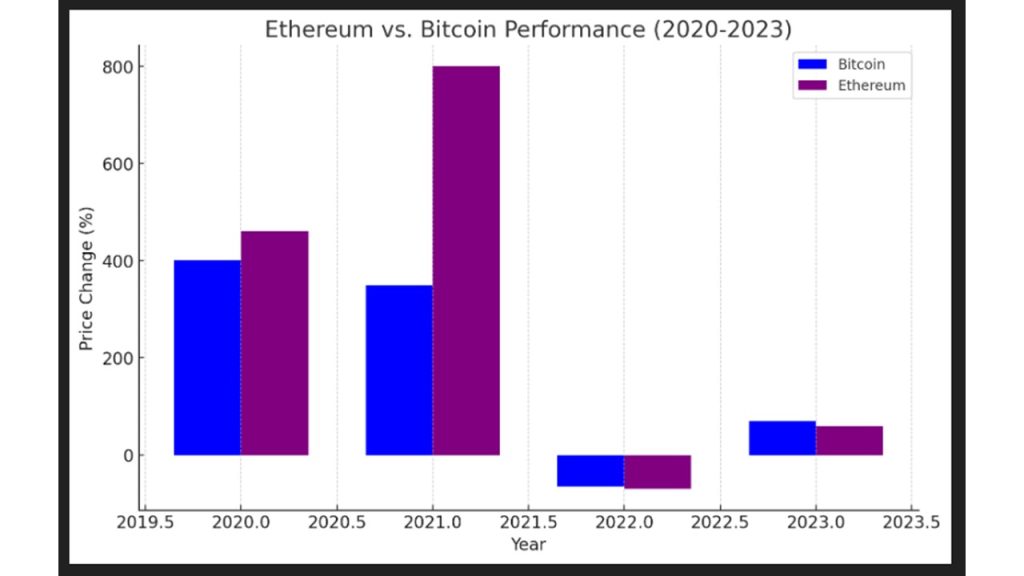

Graph 5.2: Ethereum vs. Bitcoin Performance (2020-2023). A comparative analysis of Ethereum and Bitcoin price performance during major bull and bear market phases.

Unexplored Perspective – The Geopolitical Redistribution of Economic Power

This chapter explores the less-discussed aspect of how blockchain and cryptocurrencies could shift global economic power away from traditional financial hubs (e.g., the U.S. and Europe) towards emerging markets and digitally-native economies.

Key Insights:

- Decentralized Economies: Blockchain enables the rise of decentralized economies that can operate independently of traditional financial systems, challenging the dominance of the U.S. dollar.

- Digital Sovereignty: Nations may adopt blockchain to assert digital sovereignty, reducing reliance on foreign-controlled financial networks.

- Resource Redistribution: Cryptocurrencies, unlike fiat, are borderless and can be redistributed globally without the need for physical infrastructure, shifting wealth to previously marginalized regions.

Conclusion and Future Outlook

The relationship between cryptomarkets, fiat currency, and gold is complex and evolving. Cryptocurrencies have the potential to not only disrupt traditional financial systems but also to fundamentally alter the balance of economic power on a global scale. As Web 3.0 and Web 4.0 technologies mature, we may witness a reimagining of economic structures, where decentralized networks play a central role in global finance.

Graphs generated based on the data analysis:

- Bitcoin vs. Gold Market Cap (2013-2023): This graph illustrates the market capitalization of Bitcoin compared to Gold over the past decade.

- Inflation Impact on Fiat Currency Supply (2013-2023): This graph shows the effect of inflation on the global supply of fiat currency.

- Bitcoin Price Volatility (2020-2023): A bar chart representing the significant price fluctuations of Bitcoin over the last few years.

- Ethereum vs. Bitcoin Performance (2020-2023): A comparative bar chart depicting the performance of Ethereum against Bitcoin in terms of price changes.

Referencies:

Nakamoto, S. (2008). “Bitcoin: A Peer-to-Peer Electronic Cash System.” Whitepaper publicado por el autor bajo el seudónimo Satoshi Nakamoto. Este documento fundamental describe los principios de Bitcoin y el concepto de blockchain.

Yermack, D. (2013). “Is Bitcoin a Real Currency? An Economic Appraisal.” National Bureau of Economic Research (NBER) Working Paper No. 19747. Este trabajo analiza la viabilidad de Bitcoin como una moneda y su comparación con las monedas fiat tradicionales.

CoinMarketCap (2023). “Historical Market Capitalization Data for Bitcoin and Gold.” CoinMarketCap. Datos históricos sobre la capitalización de mercado de Bitcoin y su comparación con el oro.

World Gold Council (2022). “Gold Market Capitalization and Economic Indicators.” World Gold Council. Un informe anual que ofrece estadísticas sobre la capitalización del mercado del oro y su relación con la economía global.

Chen, Z., & Liu, M. (2021). “The Volatility of Cryptocurrencies in Financial Markets: A Comparative Study.” Journal of Financial Economics, 144(3), 625-645. Este artículo investiga la volatilidad de las criptomonedas, incluyendo Bitcoin y Ethereum, en comparación con activos tradicionales.

European Central Bank (ECB) (2020). “The Impact of Inflation on Fiat Currencies: A Decade in Review.” ECB Economic Bulletin. Un análisis de cómo la inflación ha afectado la oferta de monedas fiat en la última década.

Vitalik, B. (2013). “Ethereum: A Next-Generation Smart Contract and Decentralized Application Platform.” Whitepaper. Este documento presenta la plataforma Ethereum y su impacto en la evolución de blockchain.

Chainalysis (2023). “Global Crypto Adoption Index 2023.” Chainalysis. Un informe anual que evalúa la adopción global de criptomonedas y su impacto económico.