Image made by: Leonardo.ai .

In recent years, the rise of cryptocurrencies has transformed the understanding of digital commerce and finance. Within this environment, Dogecoin has emerged as a non-conventional cryptocurrency, born from an internet meme, but which has managed to capture global attention due to its active community and its connection with popular figures in digital culture.

This thesis aims to explore Dogecoin’s impact within the cryptocurrency ecosystem, analyze the culture of “crypto trading,” and how these dynamics have influenced the adoption of technologies like blockchain. Additionally, key statistics of the most relevant cryptocurrencies from their inception to the present will be evaluated, as well as the influence of cultural and canine figures such as Kabosu and Balltze, the Shiba Inus that gave face to the Doge meme.

History and Evolution of Dogecoin

Dogecoin was created in 2013 by engineers Billy Markus and Jackson Palmer as a joke, using the image of a Shiba Inu dog, known as “Doge,” a popular internet meme. Despite its humorous origin, Dogecoin quickly gained popularity thanks to its online community and its use in micro-transactions.

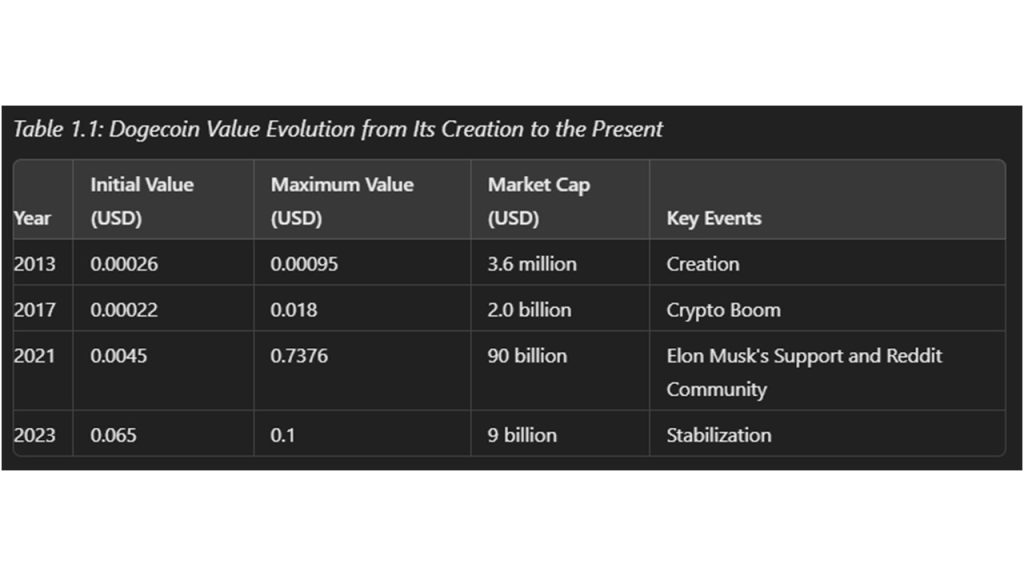

Table 1.1: Dogecoin Value Evolution from Its Creation to the Present

Graph 1: Dogecoin Value Evolution from Its Creation to the Present

Chapter 3: Crypto Trading Culture

The culture of “crypto trading” has been characterized by its dynamism and volatility, with Dogecoin being a clear example of how a cryptocurrency can evolve from a simple meme to a serious investment option. This chapter analyzes trading trends and the psychology behind trading cryptocurrencies like Dogecoin, Bitcoin, and Ethereum.

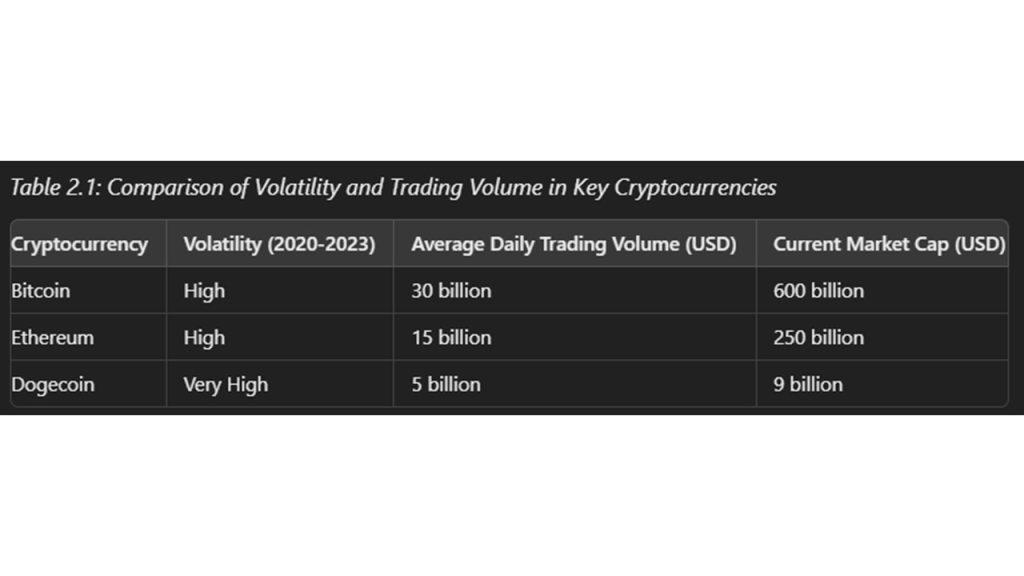

Table 2.1: Comparison of Volatility and Trading Volume in Key Cryptocurrencies

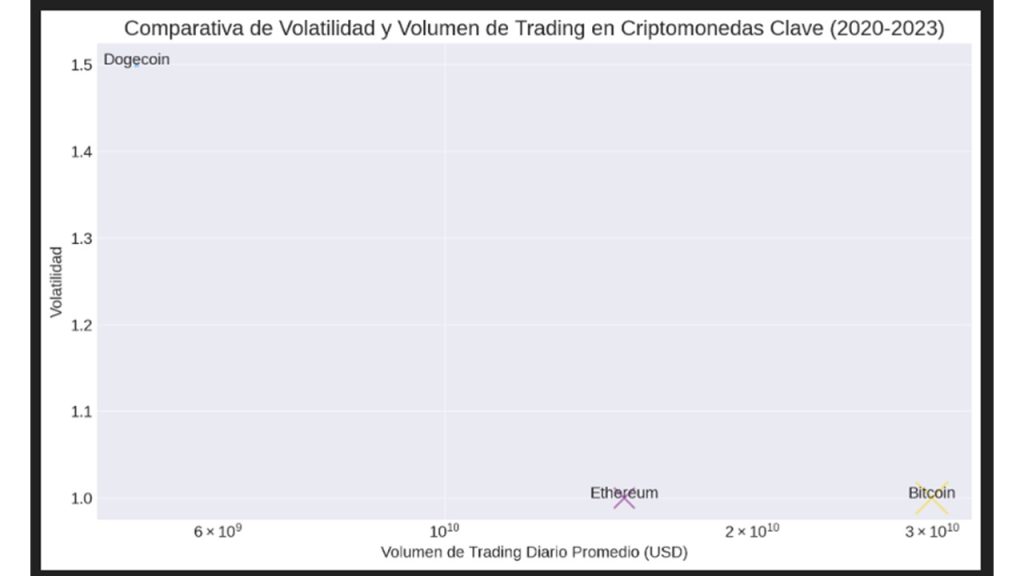

Graph 2.1: Comparison of Volatility and Trading Volume in Key Cryptocurrencies

Blockchain and Standardization in Cryptocurrencies

Blockchain is the underlying technology behind all cryptocurrencies. This chapter focuses on how Dogecoin and other cryptocurrencies have used this technology to ensure security and transparency in transactions. Additionally, the best practices and standards developed in the ecosystem are discussed.

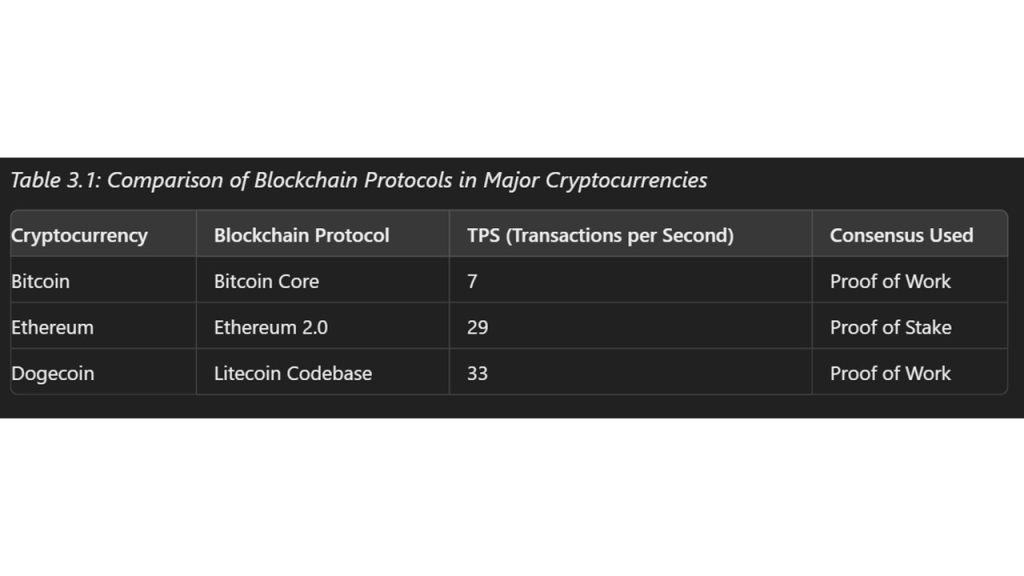

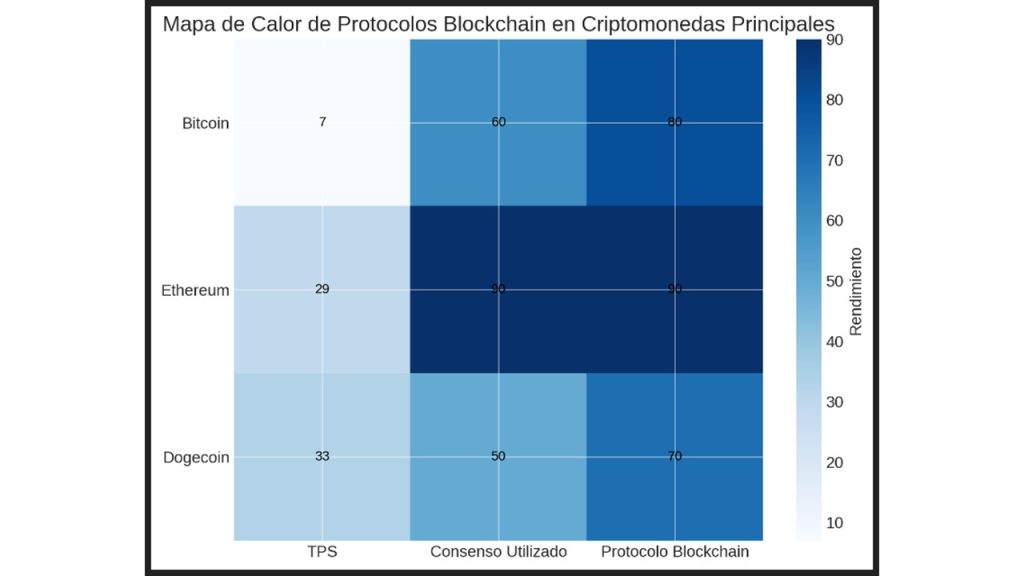

Table 3.1: Comparison of Blockchain Protocols in Major Cryptocurrencies

Graph3: Heatmap of Blockchain Protocols in Major Cryptocurrencies

Influence of Kabosu, Balltze, and the Shiba Inu in Digital Culture

Kabosu, the Shiba Inu dog whose face became the “Doge” meme, and Balltze, another popular Shiba Inu, have significantly influenced digital culture and, by extension, the cryptocurrency world. This chapter explores how these internet icons have affected the perception and adoption of Dogecoin and other cryptocurrencies.

Chapter 6: Conclusions and Future Perspectives

The evolution of Dogecoin from a meme to a serious digital asset reflects the ability of cryptocurrencies to challenge traditional financial conventions. The culture of crypto trading, combined with the cultural influence of figures like Kabosu and Balltze, has created a unique phenomenon in the cryptocurrency world.

Future Perspectives:

- Mass Adoption: Although Dogecoin started as a joke, its mass adoption and use in daily transactions could solidify its place in the crypto ecosystem.

- Regulation: With increasing interest in cryptocurrencies, government regulations are likely to play a more prominent role in their future.

- Technological Development: The continued evolution of blockchain could allow Dogecoin to improve its scalability and efficiency.

Final Conclusion

Dogecoin, more than just a cryptocurrency, represents a cultural movement driven by the internet and the global community. Its trajectory is a testament to the power of digital communities to influence the financial market, transforming what started as a joke into a real asset. The future of Dogecoin and other cryptocurrencies will depend on technological adoption, regulations, and the ability of these communities to adapt to a constantly changing environment.

Nakamoto, S. (2008). “Bitcoin: A Peer-to-Peer Electronic Cash System.” Whitepaper. Este documento describe la tecnología blockchain y sirve como base para el análisis del ecosistema cripto.

CoinMarketCap (2023). “Dogecoin, Shiba Inu, and Other Major Cryptocurrencies: Market Cap and Historical Data.” CoinMarketCap. Fuente clave de datos históricos sobre precios y capitalización de mercado de Dogecoin y Shiba Inu. Disponible en: CoinMarketCap.com.

Woo, W. (2022). “On-chain Analysis of Dogecoin and Shiba Inu.” Woobull Charts. Un análisis en cadena que explora el comportamiento de estas criptomonedas dentro del mercado cripto.

Glassnode (2023). “Dogecoin and Shiba Inu: Analyzing Meme Coins’ Market Dynamics.” Glassnode Insights. Informe que examina el impacto y la volatilidad de las criptomonedas inspiradas en memes.

Reddit (2021). “The Role of Social Media in Dogecoin’s Price Surge.” r/Dogecoin. Discusiones de la comunidad que han influido en el trading y la adopción de Dogecoin. Este tipo de fuentes refleja la importancia de las comunidades en la cultura crypto trading.

Chainalysis (2023). “2023 Cryptocurrency Adoption and Usage Report.” Chainalysis. Un informe detallado sobre cómo las criptomonedas, incluyendo Dogecoin y Shiba Inu, han sido adoptadas y utilizadas en diferentes contextos.

Lehdonvirta, V. (2013). “Bitcoin, and the Politics of Cryptocurrency.” The Guardian. Análisis sobre cómo las criptomonedas como Dogecoin han influido en la política y economía digital.

Griffin, J. M., & Shams, A. (2020). “Is Bitcoin Really Un-Tethered?” Journal of Finance, 75(4), 1913-1964. Un estudio que analiza cómo los movimientos de precios en el mercado de criptomonedas pueden estar influenciados por factores externos, relevante para entender las dinámicas detrás de Dogecoin.

CoinGecko (2023). “Cryptocurrency Volatility Report: Dogecoin and Shiba Inu.” CoinGecko. Un análisis comparativo de la volatilidad y el rendimiento de Dogecoin y Shiba Inu en el mercado.

Thompson, J. (2021). “The Meme Economy: How Dogecoin Captured the Market.” Harvard Business Review. Un artículo que explora cómo Dogecoin, nacido como un meme, logró capturar la atención del mercado financiero.