Image made by: Leonardo.ai

Web 3.0 represents the next evolution of the internet, characterized by decentralized networks, blockchain technology, and smart contracts. This thesis explores the implications of Web 3.0 on the decentralized financial (DeFi) ecosystem, highlighting both the opportunities and risks it poses to global economic stability. The analysis includes a comprehensive review of Web 3.0 technologies, statistical data on the growth of DeFi, and a discussion of regulatory challenges. Graphs and tables are provided to support the findings, along with Python code to replicate the visualizations.

Chapter 1: Introduction

1.1 Background

The transition from Web 2.0 to Web 3.0 is marked by a shift from centralized platforms to decentralized networks that empower users to control their data and participate directly in economic activities. The rise of blockchain technology, which underpins cryptocurrencies and decentralized finance (DeFi), has enabled the creation of a new financial ecosystem that operates independently of traditional financial institutions.

1.2 Research Objectives

The primary objectives of this thesis are:

- To explore the key components of Web 3.0 and their role in the decentralized financial ecosystem.

- To analyze the growth and impact of DeFi on global financial markets.

- To assess the opportunities and risks associated with the widespread adoption of Web 3.0 and DeFi.

- To provide policy recommendations for ensuring global economic stability in the context of these emerging technologies.

1.3 Research Questions

- What are the core technologies driving Web 3.0?

- How has the DeFi ecosystem evolved, and what are its key components?

- What opportunities does Web 3.0 present for financial inclusion and innovation?

- What risks does the decentralized financial ecosystem pose to global economic stability?

- How should regulators approach the governance of Web 3.0 and DeFi?

What are the core technologies driving Web 3.0?

- Web 3.0 is built on the foundations of decentralization, blockchain technology, and artificial intelligence. At its core, it represents a shift towards a more democratized internet where users have greater control over their data and digital assets.

- Blockchain is particularly revolutionary as it provides a secure, transparent, and immutable ledger that underpins decentralized finance (DeFi) and smart contracts. The integration of AI and machine learning with blockchain can enable intelligent, automated systems that operate independently, creating new efficiencies and reducing the need for intermediaries. However, while these technologies are powerful, they must be deployed in a way that is secure, scalable, and sustainable to truly revolutionize the web.

How has the DeFi ecosystem evolved, and what are its key components?

- DeFi has evolved from a niche segment of the crypto market into a multi-billion-dollar ecosystem that challenges traditional financial institutions. The key components of DeFi include decentralized exchanges (DEXs), lending platforms, stablecoins, and yield farming protocols.

- The DeFi space is growing rapidly because it offers financial services without the need for traditional banks, which can be inefficient and exclusionary. Smart contracts facilitate these services, allowing users to trade, lend, and borrow assets without a centralized authority. However, while the growth is impressive, the DeFi ecosystem is still in its infancy and needs to overcome challenges like security vulnerabilities and the potential for systemic risks as it scales.

What opportunities does Web 3.0 present for financial inclusion and innovation?

- Web 3.0 presents unparalleled opportunities for financial inclusion and innovation. In a world where billions of people remain unbanked, DeFi can bring financial services to anyone with an internet connection, regardless of their location or socioeconomic status. This is particularly important in developing countries where traditional banking infrastructure is lacking or inaccessible.

- The innovation potential is also significant. By removing intermediaries and lowering barriers to entry, Web 3.0 allows for the creation of new financial products and services that were previously unimaginable. The ability to tokenize assets, create decentralized autonomous organizations (DAOs), and implement microtransactions at scale can redefine how we interact with the economy.

What risks does the decentralized financial ecosystem pose to global economic stability?

- While Web 3.0 and DeFi offer exciting opportunities, they also pose significant risks to global economic stability. The decentralized nature of these technologies makes them difficult to regulate, and the lack of oversight can lead to fraudulent activities, money laundering, and other illicit activities.

- Moreover, the high volatility of crypto assets, coupled with the potential for systemic failures in the DeFi space, could trigger financial instability on a global scale. If major DeFi protocols were to fail or be compromised, the ripple effects could be catastrophic, given the interconnectedness of the global financial system.

How should regulators approach the governance of Web 3.0 and DeFi?

- Regulators face a delicate balancing act when it comes to Web 3.0 and DeFi. On one hand, they must protect consumers and ensure the stability of the financial system; on the other hand, they must avoid stifling innovation. A heavy-handed regulatory approach could drive innovation underground or push it to jurisdictions with looser regulations, while too light a touch could lead to widespread abuses and financial crises.

- The ideal approach is a collaborative one, where regulators work with developers, entrepreneurs, and the broader community to create frameworks that encourage innovation while addressing key risks. Regulatory sandboxes, for instance, can provide a controlled environment where new technologies can be tested without exposing the broader financial system to undue risk.

- In the long run, the successful integration of Web 3.0 and DeFi into the global economy will depend on the ability to strike this balance, ensuring that these technologies can fulfill their potential while maintaining the stability and integrity of the financial system.

Chapter 2: The Evolution of Web 3.0

2.1 From Web 1.0 to Web 3.0

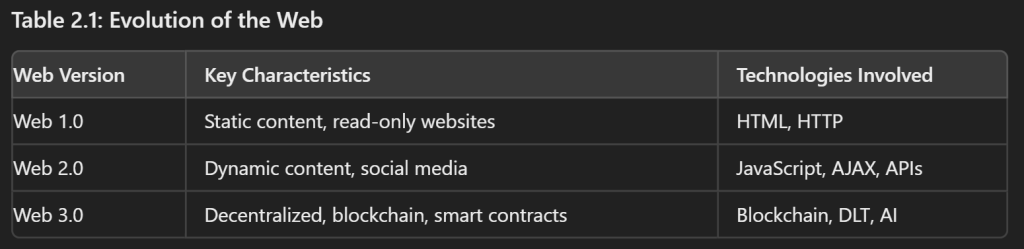

Web 1.0 was characterized by static, read-only web pages, while Web 2.0 introduced dynamic content, social media, and user-generated content. Web 3.0 represents the next evolution, focusing on decentralization, user control, and blockchain technology.

Table 2.1: Evolution of the Web

2.2 Core Technologies of Web 3.0

- Blockchain: The foundational technology that enables decentralized networks by providing a transparent and secure ledger of transactions.

- Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code, eliminating the need for intermediaries.

- Decentralized Applications (dApps): Applications that run on decentralized networks, offering services without centralized control.

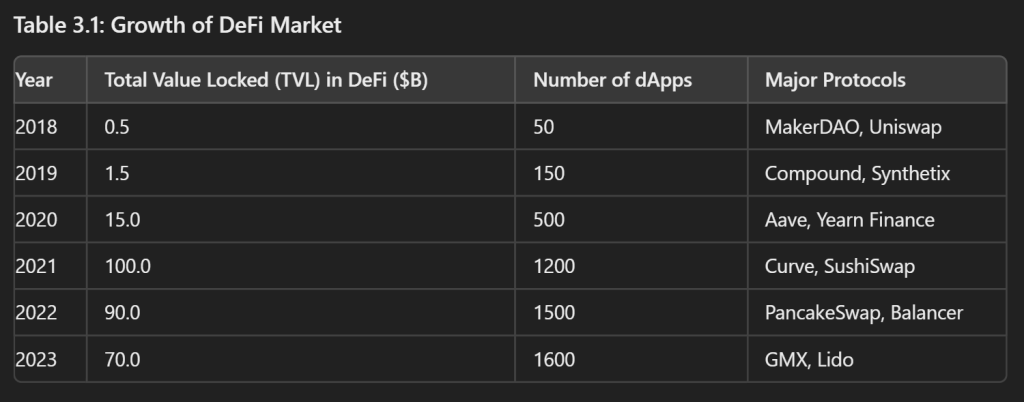

3.1 Overview of DeFi

Decentralized Finance (DeFi) refers to a financial system that operates on decentralized networks, utilizing smart contracts to offer financial services such as lending, borrowing, trading, and asset management without the need for traditional financial intermediaries.

Table 3.1: Growth of DeFi Market

3.2 DeFi Components and Use Cases

- Lending and Borrowing: Platforms like Aave and Compound allow users to lend their assets for interest or borrow against collateral.

- Decentralized Exchanges (DEXs): Uniswap and SushiSwap enable peer-to-peer trading of cryptocurrencies without the need for centralized exchanges.

- Stablecoins: Cryptocurrencies like DAI and USDC that are pegged to traditional fiat currencies to provide stability in transactions.

- Yield Farming: A strategy where users stake their assets in DeFi protocols to earn rewards, often in the form of governance tokens.

Chapter 4: Opportunities Presented by Web 3.0 and DeFi

4.1 Financial Inclusion

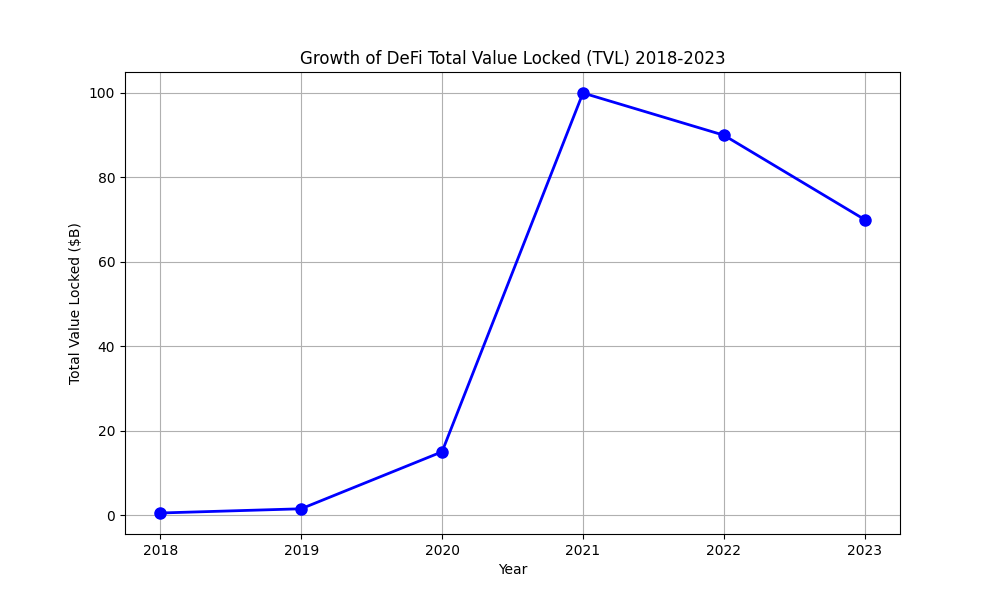

Web 3.0 and DeFi have the potential to democratize access to financial services, particularly in regions with limited access to traditional banking infrastructure. By removing intermediaries, DeFi platforms can offer lower fees and greater accessibility.

4.2 Innovation in Financial Services

The programmability of smart contracts allows for the creation of new financial products and services that were not possible in traditional finance. This includes automated market makers (AMMs), flash loans, and synthetic assets.

Graph 4.1: Growth of DeFi Total Value Locked (TVL) 2018-2023

4.3 Decentralization and User Empowerment

Web 3.0 empowers users by giving them control over their data and assets. This decentralization reduces the power of traditional financial institutions and enables more transparent and fair financial systems.

Chapter 5: Risks Associated with Web 3.0 and DeFi

5.1 Security Risks

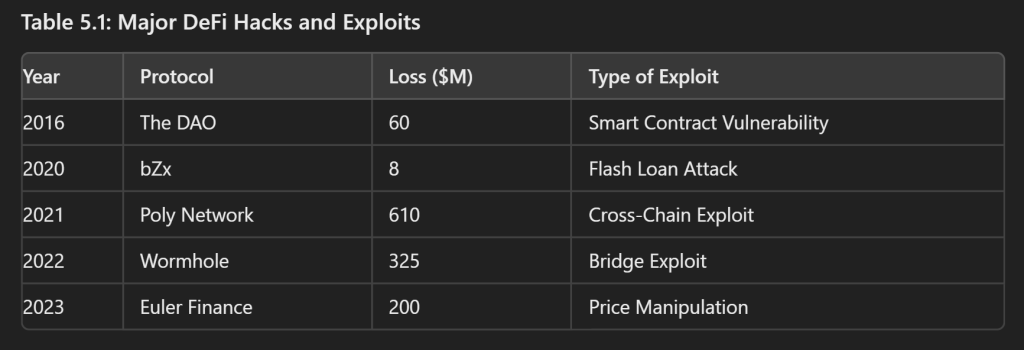

Smart Contract Vulnerabilities

Smart contracts are the backbone of the decentralized financial ecosystem, enabling automation without the need for intermediaries. However, they are essentially immutable once deployed, meaning that any bug or vulnerability in the code can have catastrophic consequences. The risks associated with smart contracts stem from the complexity of the code, which is often developed rapidly to keep pace with the fast-moving crypto market.

These vulnerabilities can be exploited by malicious actors, leading to significant financial losses. For example, coding errors or poor design choices have resulted in bugs that allowed attackers to drain funds from smart contracts, as seen in the infamous DAO hack where over $60 million in Ether was stolen. To mitigate these risks, rigorous code auditing, formal verification methods, and the development of more robust coding standards are essential. The potential of smart contracts is immense, but without secure coding practices, the risks can outweigh the benefits.

While smart contracts automate processes, they are only as secure as their code. Bugs and vulnerabilities in smart contracts have led to significant losses in the DeFi space.

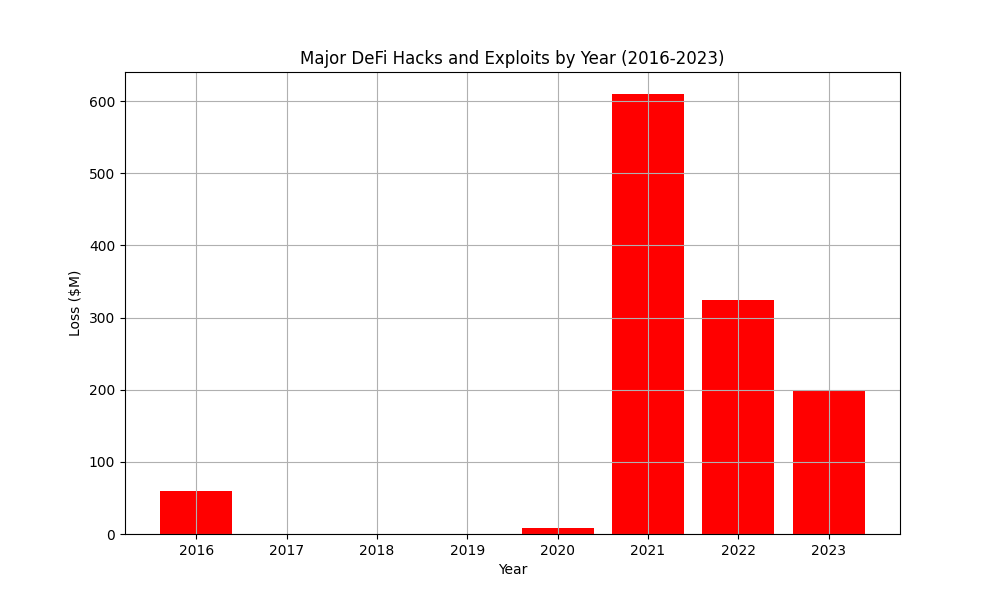

Hacks and Exploits.

The decentralized nature of DeFi platforms makes them a prime target for cyberattacks. Unlike traditional financial institutions, which have established security protocols and insurance mechanisms, many DeFi projects operate with little oversight and minimal security infrastructure. The openness and transparency of blockchain technology, while advantageous for verifying transactions, also allow attackers to scrutinize the code for vulnerabilities.

The DAO hack and the Poly Network exploit are prime examples of how vulnerabilities can be exploited at scale. The DAO hack, one of the earliest and most significant incidents, resulted in a hard fork of the Ethereum blockchain, splitting it into Ethereum and Ethereum Classic. This event highlighted not only the security risks inherent in DeFi but also the potential for governance challenges within decentralized systems.

The Poly Network exploit, where over $600 million was stolen (and later returned), underscored the sophistication of modern attackers and the importance of comprehensive security measures. To reduce the likelihood of such incidents, DeFi platforms must prioritize security from the ground up, including regular penetration testing, continuous monitoring, and the implementation of decentralized insurance protocols that can cover losses in the event of a breach.

DeFi platforms are frequent targets of cyberattacks, with millions of dollars lost to hacks such as the DAO hack and the Poly Network exploit.

A Broader Economic Impact

The security risks posed by smart contract vulnerabilities and cyberattacks extend beyond individual losses and have broader implications for global economic stability. As DeFi grows in scale and becomes more integrated with traditional financial systems, a major security breach could have ripple effects across the global economy. The interconnectedness of DeFi protocols, along with the massive capital flows they handle, means that a single exploit could lead to widespread market panic, loss of confidence, and significant financial disruption.

For example, if a leading stablecoin were to be compromised, it could trigger a liquidity crisis that reverberates through both the crypto and traditional financial markets. Such an event would not only cause direct financial losses but could also undermine the credibility of DeFi as a whole, slowing adoption and innovation. Therefore, it is crucial that both developers and regulators work together to establish robust security frameworks that can safeguard the integrity of the decentralized financial ecosystem.

In conclusion, while the potential of Web 3.0 and DeFi is vast, the security challenges they face must not be underestimated. Addressing these risks head-on, through a combination of technological innovation, rigorous testing, and proactive regulation, is essential for ensuring that these emerging technologies can fulfill their promise without compromising global economic stability.

Table 5.1: Major DeFi Hacks and Exploits

5.2 Regulatory Challenges

The decentralized nature of Web 3.0 and DeFi poses significant challenges for regulators. Traditional regulatory frameworks are not well-suited to decentralized systems, leading to concerns about compliance, fraud, and the potential for illicit activities.

5.3 Economic Risks

- Market Volatility: The value of assets in DeFi can be highly volatile, leading to potential financial instability.

- Systemic Risks: As DeFi grows, the interconnectedness of protocols can create systemic risks, where the failure of one platform could lead to cascading failures across the ecosystem.

Graph 5.1: Major DeFi Hacks and Exploits by Year (2016-2023)

Chapter 6: Policy Recommendations

6.1 Regulatory Frameworks

Governments and regulators should develop frameworks that address the unique challenges of Web 3.0 and DeFi without stifling innovation. This includes:

- Smart Contract Audits: Mandating regular audits of smart contracts to reduce vulnerabilities.

- KYC/AML Compliance: Implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations tailored to decentralized platforms.

6.2 Collaboration Between Stakeholders

Effective regulation requires collaboration between governments, private sector participants, and the broader blockchain community. By working together, stakeholders can develop standards and best practices that enhance security and trust in the decentralized ecosystem.

6.3 Education and Awareness

Raising awareness about the risks and opportunities of Web 3.0 and DeFi is crucial for both consumers and policymakers. Education initiatives can help bridge the knowledge gap and promote informed decision-making.

Chapter 7: Conclusion

Web 3.0 and the decentralized financial ecosystem represent a paradigm shift in how financial services are delivered and accessed. While the opportunities for innovation, financial inclusion, and user empowerment are immense, they come with significant risks, particularly in terms of security, regulation, and economic stability. As these technologies continue to evolve, it will be essential to strike a balance between fostering innovation and ensuring the safety and stability of the global financial system.

References

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System.

- Ethereum Foundation. (2015). Ethereum Whitepaper.

- DeFi Pulse. (2023). DeFi Total Value Locked (TVL) Metrics.

- World Economic Forum. (2021). Decentralized Finance: Defining and Measuring Decentralized Finance.

- BIS. (2022). The Rise of DeFi: Implications for Financial Stability.

- Chainalysis. (2023). The 2023 Crypto Crime Report.

- FATF. (2022). Guidance on a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers.

- IMF. (2022). Global Financial Stability Report: Navigating the High-Inflation Environment.

- World Bank. (2023). The Future of Finance: Decentralization and Digital Transformation.